Question: help please asap 32. What is the formula for computing the present value of a cash flow? 1 33. What is the formula for computing

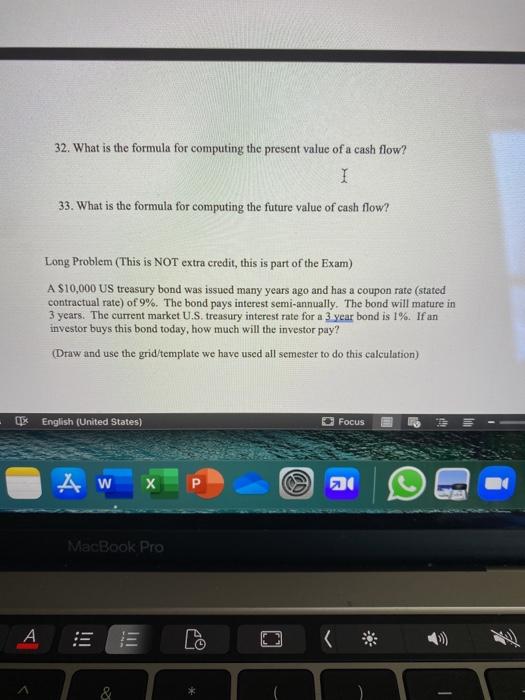

32. What is the formula for computing the present value of a cash flow? 1 33. What is the formula for computing the future value of cash flow? Long Problem (This is NOT extra credit this is part of the Exam) A $10,000 US treasury bond was issued many years ago and has a coupon rate (stated contractual rate) of 9%. The bond pays interest semi-annually. The bond will mature in 3 years. The current market U.S. treasury interest rate for a 3 year bond is 1%. If an investor buys this bond today, how much will the investor pay? (Draw and use the grid/template we have used all semester to do this calculation) * English (United States) Focus Aw 2 MacBook Pro &

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts