Question: Help please! Assume that your company is implementing a strategy that requires that the portfolio value P is neutral to changes in the slope of

Help please!

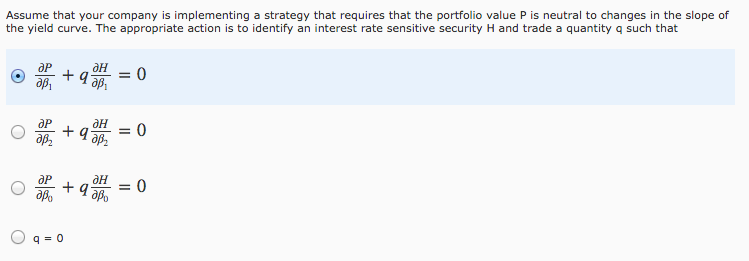

Assume that your company is implementing a strategy that requires that the portfolio value P is neutral to changes in the slope of the yield curve. The appropriate action is to identify an interest rate sensitive security H and trade a quantity q such that partial differential P/partial differential beta_1 + q partial differential H/partial differential beta_1 = 0 partial differential P/partial differential beta_2 + q partial differential H/partial differential beta_2 = 0 partial differential P/partial differential beta_0 + q partial differential H/partial differential beta_0 = 0 q = 0 Assume that your company is implementing a strategy that requires that the portfolio value P is neutral to changes in the slope of the yield curve. The appropriate action is to identify an interest rate sensitive security H and trade a quantity q such that partial differential P/partial differential beta_1 + q partial differential H/partial differential beta_1 = 0 partial differential P/partial differential beta_2 + q partial differential H/partial differential beta_2 = 0 partial differential P/partial differential beta_0 + q partial differential H/partial differential beta_0 = 0 q = 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts