Question: help please!! Beta coefficients and the capital asset pricing model Personal Finance Problem Katherine Wison is wondering how much risk she must undertake to generate

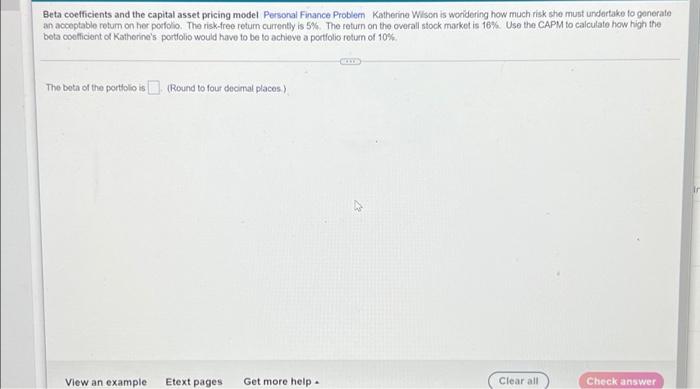

Beta coefficients and the capital asset pricing model Personal Finance Problem Katherine Wison is wondering how much risk she must undertake to generate an acceptable robum on her porfolio. The risk-free retum currently is 5% The return on the overall stock market is 16% Use the CAPM to calculato how high the beta coefficient of Katherine's portfolio would have to be to achieve a portfolio roturn of 10% The beta of the portfolio is (Round to four decimal places) View an example Etext pages Get more help Clear all Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts