Question: Help please Chapter 8 What are long-term operational assets? Assets used by a business, normally over multiple accounting periods, to generate revenue. What are assets

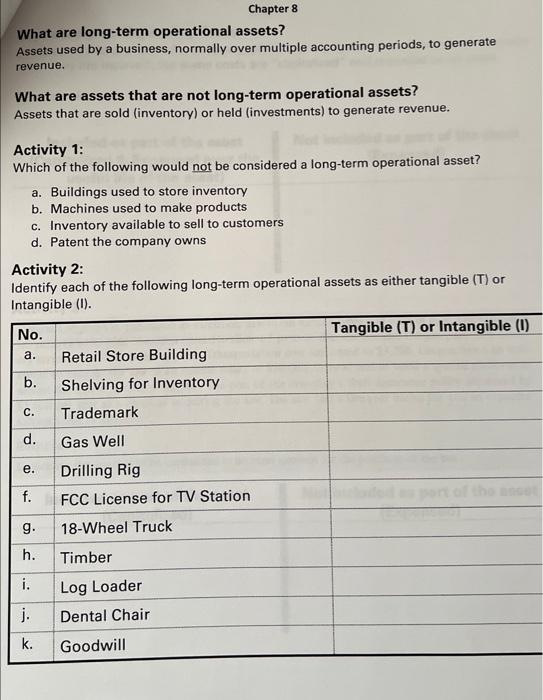

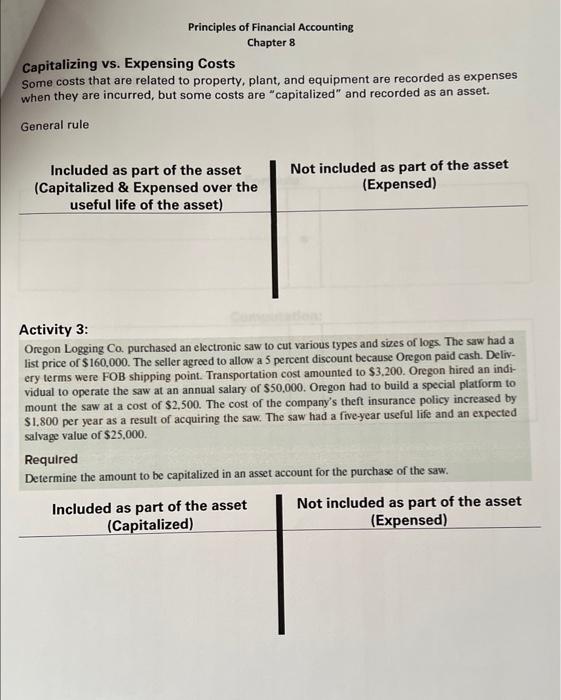

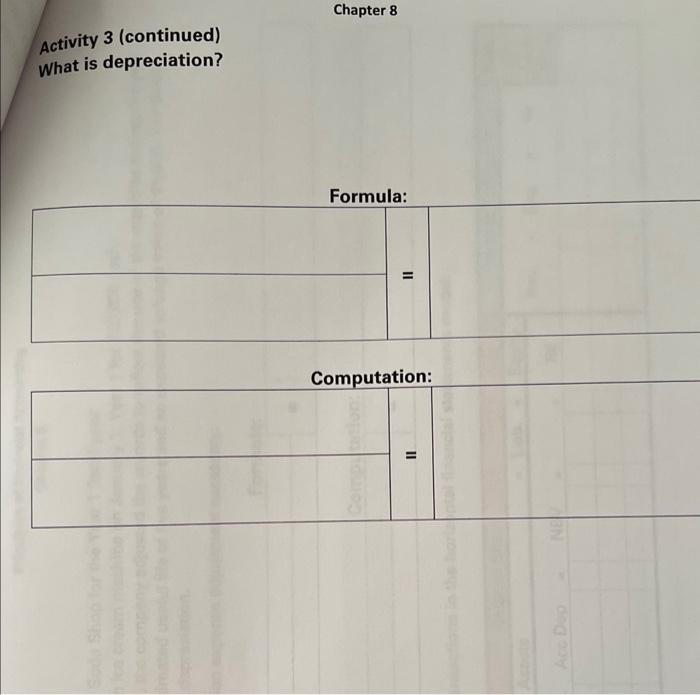

Chapter 8 What are long-term operational assets? Assets used by a business, normally over multiple accounting periods, to generate revenue. What are assets that are not long-term operational assets? Assets that are sold (inventory) or held (investments) to generate revenue. Activity 1: Which of the following would not be considered a long-term operational asset? a. Buildings used to store inventory b. Machines used to make products c. Inventory available to sell to customers d. Patent the company owns Activity 2: Identify each of the following long-term operational assets as either tangible (T) or Intangible (I). Activity 3: Orgon Logging Co. purchased an electronic saw to cut various types and sizes of logs. The saw had a list price of $160,000. The seller agreed to allow a 5 percent discount because Oregon paid cash. Delivery terms were FOB shipping point. Transportation cost amounted to $3,200. Oregon hired an individual to operate the saw at an annual salary of $50,000. Oregon had to build a special platform to mount the saw at a cost of $2,500. The cost of the company's theft insurance policy increased by $1.800 per year as a result of acquiring the saw. The saw had a five-year useful life and an expected salvage value of $25,000. Required Determine the amount to be capitalized in an asset account for the purchase of the saw. Activity 3 (continued) What is depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts