Question: Help please Computing, Analyzing, and Interpreting Return on Equity and Return on Assets Following are summary financial statement data for Logitech International for 2016 through

Help please

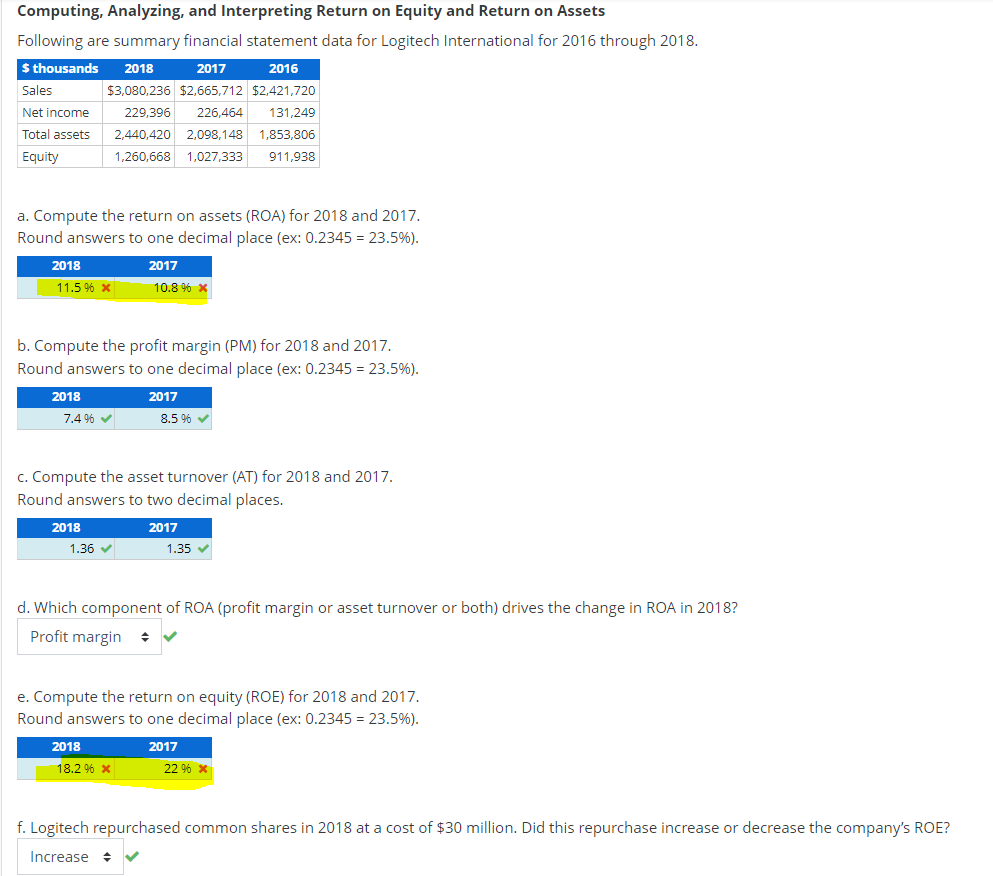

Computing, Analyzing, and Interpreting Return on Equity and Return on Assets Following are summary financial statement data for Logitech International for 2016 through 2018. $ thousands 2018 2017 2016 Sales $3,080,236 $2,665,712 $2,421,720 Net income Total assets 229,396 226,464 131,249 2,440,420 2,098,148 1,853,806 1,260,668 1,027,333 911,938 Equity a. Compute the return on assets (ROA) for 2018 and 2017. Round answers to one decimal place (ex: 0.2345 = 23.5%). 2018 2017 11.5% 10.8 % * b. Compute the profit margin (PM) for 2018 and 2017. Round answers to one decimal place (ex: 0.2345 = 23.5%). 2018 2017 7.4% 8.5% c. Compute the asset turnover (AT) for 2018 and 2017. Round answers to two decimal places. 2018 1.36 2017 1.35 d. Which component of ROA (profit margin or asset turnover or both) drives the change in ROA in 2018? Profit margin e. Compute the return on equity (ROE) for 2018 and 2017. Round answers to one decimal place (ex: 0.2345 = 23.5%). 2018 2017 18.2% * 22 % * f. Logitech repurchased common shares in 2018 at a cost of $30 million. Did this repurchase increase or decrease the company's ROE? Increase +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts