Question: need help checking if my work is correct Computing, Analyzing, and Interpreting Return on Equity and Return on Assets Following are summary financial statement data

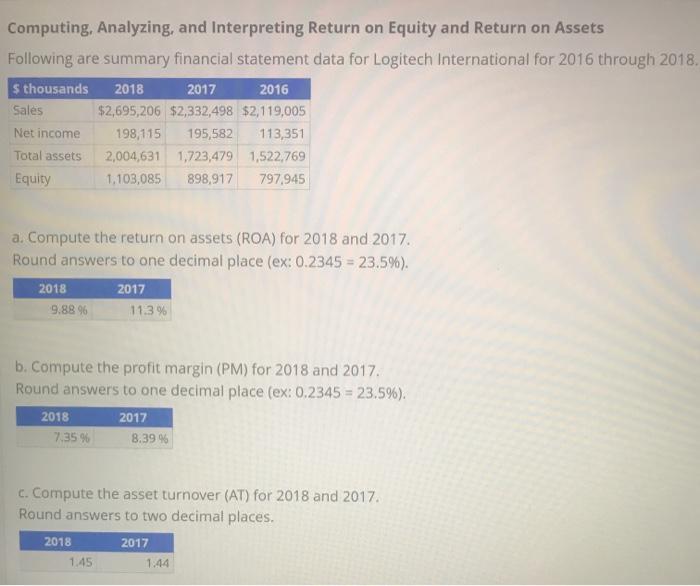

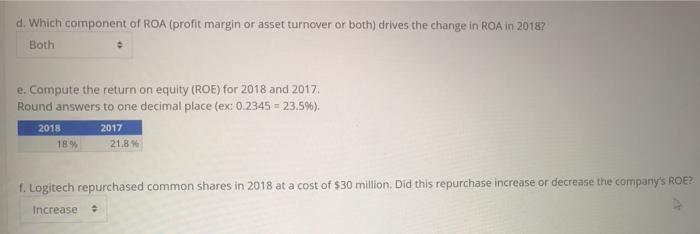

Computing, Analyzing, and Interpreting Return on Equity and Return on Assets Following are summary financial statement data for Logitech International for 2016 through 2018. $ thousands 2018 2017 2016 Sales $2,695,206 $2,332,498 $2,119,005 Net income 198,115 195,582 113,351 Total assets 2,004,631 1,723,479 1,522,769 Equity 1.103,085 898,917 797.945 a. Compute the return on assets (ROA) for 2018 and 2017. Round answers to one decimal place (ex: 0.2345 = 23.5%). 2018 2017 9.8896 113% b. Compute the profit margin (PM) for 2018 and 2017 Round answers to one decimal place (ex: 0.2345 = 23.596). 2018 2017 7.35% 8.39% c. Compute the asset turnover (AT) for 2018 and 2017 Round answers to two decimal places. 2018 2017 1.44 1.45 d. Which component of ROA (profit margin or asset turnover or both) drives the change in ROA in 2018? Both e. Compute the return on equity (ROE) for 2018 and 2017, Round answers to one decimal place (ex: 0.2345 = 23.5%). 2017 18% 21.8% 2018 1. Logitech repurchased common shares in 2018 at a cost of $30 million. Did this repurchase increase or decrease the company's ROE? Increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts