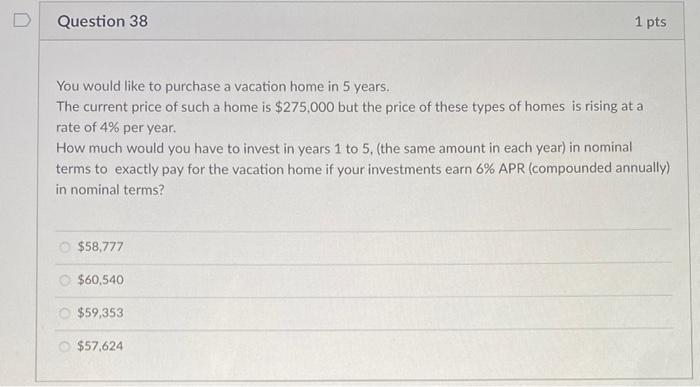

Question: help please D Question 38 1 pts You would like to purchase a vacation home in 5 years. The current price of such a home

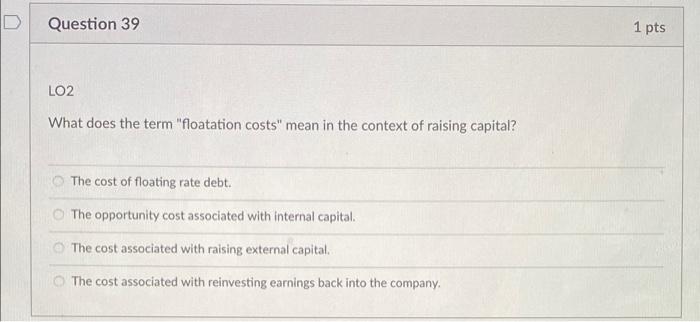

D Question 38 1 pts You would like to purchase a vacation home in 5 years. The current price of such a home is $275,000 but the price of these types of homes is rising at a rate of 4% per year. How much would you have to invest in years 1 to 5. (the same amount in each year) in nominal terms to exactly pay for the vacation home if your investments earn 6% APR (compounded annually) in nominal terms? $58,777 $60,540 $59,353 $57,624 Question 39 1 pts LO2 What does the term "floatation costs" mean in the context of raising capital? The cost of floating rate debt. The opportunity cost associated with internal capital. The cost associated with raising external capital The cost associated with reinvesting earnings back into the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts