Question: Q39 PLEASE ANSWER CORRECTLY AND PROMPTLY!! PLEASE SHOW ALL WORK!! Suppose that there are two otherwise identical companies, TwinLabs and SpinLabs. The only difference between

Q39 PLEASE ANSWER CORRECTLY AND PROMPTLY!! PLEASE SHOW ALL WORK!!

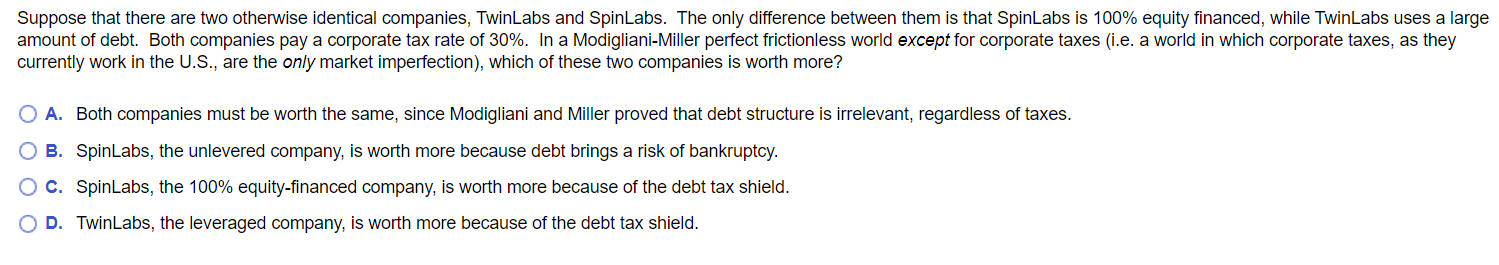

Suppose that there are two otherwise identical companies, TwinLabs and SpinLabs. The only difference between them is that SpinLabs is 100% equity financed, while TwinLabs uses a large amount of debt. Both companies pay a corporate tax rate of 30%. In a Modigliani-Miller perfect frictionless world except for corporate taxes (i.e. a world in which corporate taxes, as they currently work in the U.S., are the only market imperfection), which of these two companies is worth more? A. Both companies must be worth the same, since Modigliani and Miller proved that debt structure is irrelevant, regardless of taxes. B. SpinLabs, the unlevered company, is worth more because debt brings a risk of bankruptcy. C. SpinLabs, the 100% equity-financed company, is worth more because of the debt tax shield. D. TwinLabs, the leveraged company, is worth more because of the debt tax shield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts