Question: help please!! for the first question March 1, 2021 Roger made the following investment contributions into Roger Kasi, LLC: Subsequently, the following transactions were performed

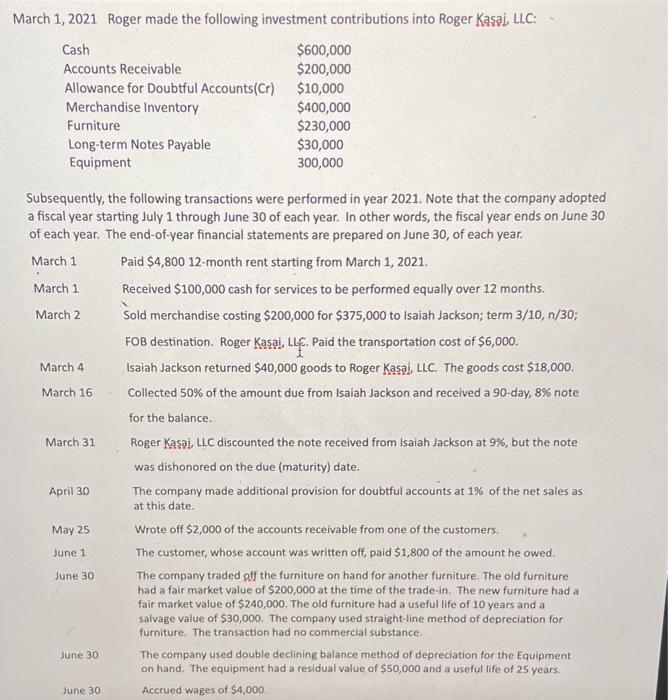

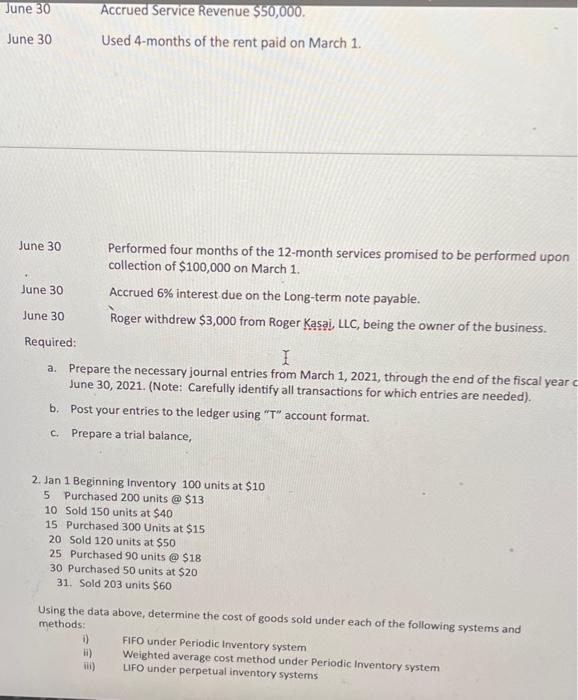

March 1, 2021 Roger made the following investment contributions into Roger Kasi, LLC: Subsequently, the following transactions were performed in year 2021. Note that the company adopted a fiscal year starting July 1 through June 30 of each year. In other words, the fiscal year ends on June 30 of each year. The end-of-year financial statements are prepared on June 30 , of each year. March 1 Paid \$4,800 12-month rent starting from March 1, 2021. March 1 Received $100,000 cash for services to be performed equally over 12 months. March 2 Sold merchandise costing $200,000 for $375,000 to Isaiah Jackson; term 3/10,n/30; FOB destination. Roger Kasaj, LLE. Paid the transportation cost of $6,000. March 4 Isaiah Jackson returned $40,000 goods to Roger Kas, LLC. The goods cost $18,000. March 16 - Collected 50% of the amount due from I saiah Jackson and received a 90 -day, 8% note for the balance. March 31 Roger Kasai, LLC discounted the note received from Isaiah Jackson at 9%, but the note was dishonored on the due (maturity) date. April 30 The company made additional provision for doubtful accounts at 1% of the net sales as at this date. May 25 Wrote off $2,000 of the accounts receivable from one of the customers. June 1 The customer, whose account was written off, paid $1,800 of the amount he owed. June 30 The company traded off the furniture on hand for another furniture. The old furniture had a fair market value of $200,000 at the time of the trade-in. The new furniture had a fair market value of $240,000. The old furniture had a useful life of 10 years and a salvage value of $30,000. The company used straight-line method of depreciation for furniture. The transaction had no commercial substance. June 30 The company used double declining balance method of depreciation for the Equipment on hand. The equipment had a residual value of $50,000 and a useful life of 25 years. June 30 Accrued 6% interest due on the Long-term note payable. June 30 Roger withdrew $3,000 from Roger Kasai, LLC, being the owner of the business. Required: a. Prepare the necessary journal entries from March 1, 2021, through the end of the fiscal year June 30, 2021. (Note: Carefully identify all transactions for which entries are needed). b. Post your entries to the ledger using " T " account format. c. Prepare a trial balance, 2. Jan 1 Beginning Inventory 100 units at $10 5 Purchased 200 units @ \$13 10 Sold 150 units at $40 15 Purchased 300 Units at $15 20 Sold 120 units at $50 25 Purchased 90 units @ \$18 30 Purchased 50 units at $20 31. Sold 203 units $60 Using the data above, determine the cost of goods sold under each of the following systems and methods: i) FIFO under Periodic Inventory system ii) Weighted average cost method under Periodic Inventory system iii) LFO under perpetual inventory systems

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts