Question: HELP PLEASE HERE's THE EXAMPLE elop a workable personal financial budget through assessment of personal spending, methods of ucing spending, incorporating the concepts of credit

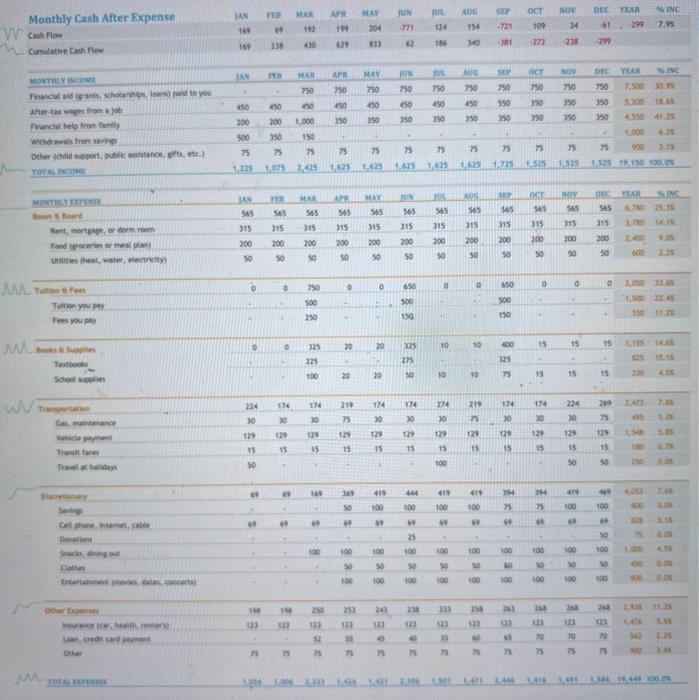

elop a workable personal financial budget through assessment of personal spending, methods of ucing spending, incorporating the concepts of credit and debt, and the effects of taxation on spending. Sunday, October 16 at 11:30 p.m. ue: 10% termine your Future Financial Situation a) Prepare a new Budget for X year in the future-consider using 2025; your first full year out of school with your first job after your diploma (see example: 5.3.1., Chapter 5), and consider your financial goals from Assignment #1. Your budget can be done using any program, but Excel may be easiest. We will review the budget template from the Financial Consumer Agency of Canada website. Please follow this template because it will ensure you consider all categories of expenses, savings, and revenue. Please consider 30% deductions from your Gross Income and use Net Income on your Budget. b) You must indicate on your budget what year has been considered. c) Include a minimum of one page of notes of assessment/explanations. Some notes could include, but not be limited to: dynamics of your household, expected job/income (considerations of gross and net income), where you will live and therefore anticipated living costs, type of car you will drive, how much disposable income you will have to spend each month on categories such as entertainment, etc., what kind of savings and retirement planning you will include, etc. d) Consider your expenses that are variable - car repairs, holiday shopping, car maintenance, etc. elop a workable personal financial budget through assessment of personal spending, methods of ucing spending, incorporating the concepts of credit and debt, and the effects of taxation on spending. Sunday, October 16 at 11:30 p.m. ue: 10% termine your Future Financial Situation a) Prepare a new Budget for X year in the future-consider using 2025; your first full year out of school with your first job after your diploma (see example: 5.3.1., Chapter 5), and consider your financial goals from Assignment #1. Your budget can be done using any program, but Excel may be easiest. We will review the budget template from the Financial Consumer Agency of Canada website. Please follow this template because it will ensure you consider all categories of expenses, savings, and revenue. Please consider 30% deductions from your Gross Income and use Net Income on your Budget. b) You must indicate on your budget what year has been considered. c) Include a minimum of one page of notes of assessment/explanations. Some notes could include, but not be limited to: dynamics of your household, expected job/income (considerations of gross and net income), where you will live and therefore anticipated living costs, type of car you will drive, how much disposable income you will have to spend each month on categories such as entertainment, etc., what kind of savings and retirement planning you will include, etc. d) Consider your expenses that are variable - car repairs, holiday shopping, car maintenance, etc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts