Question: HELP PLEASE! I cannot figure out how to find the two amounts that are in red. The first picture is an example and I'm not

HELP PLEASE!

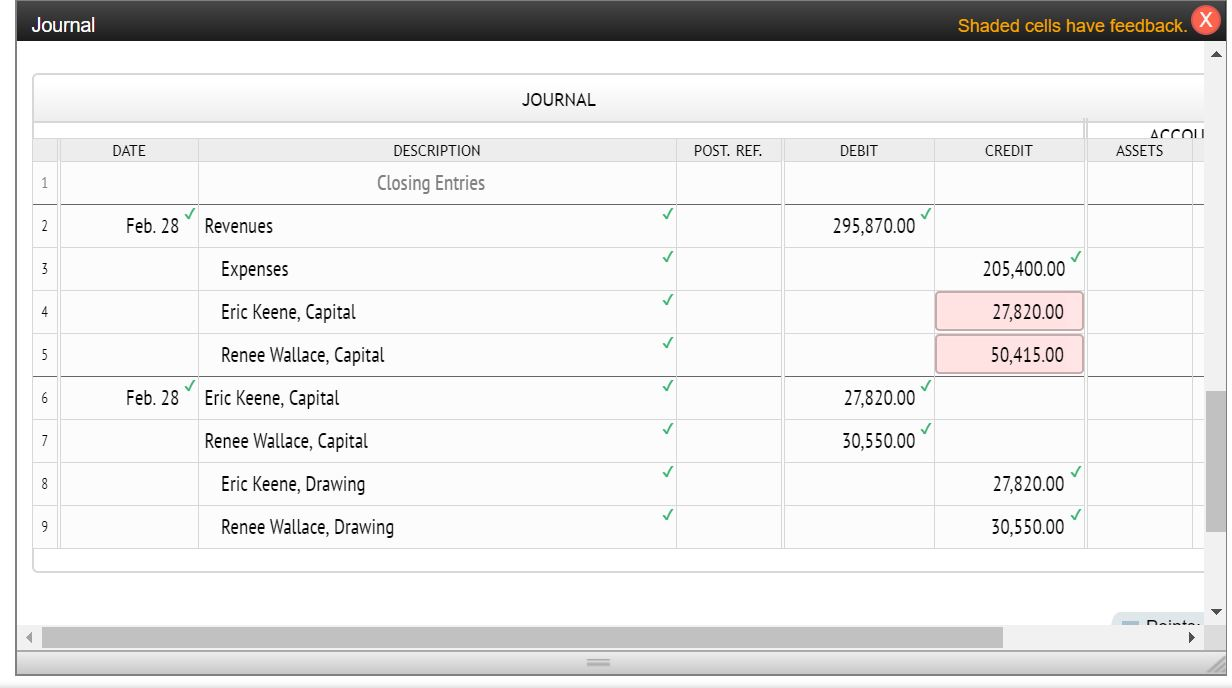

I cannot figure out how to find the two amounts that are in red.

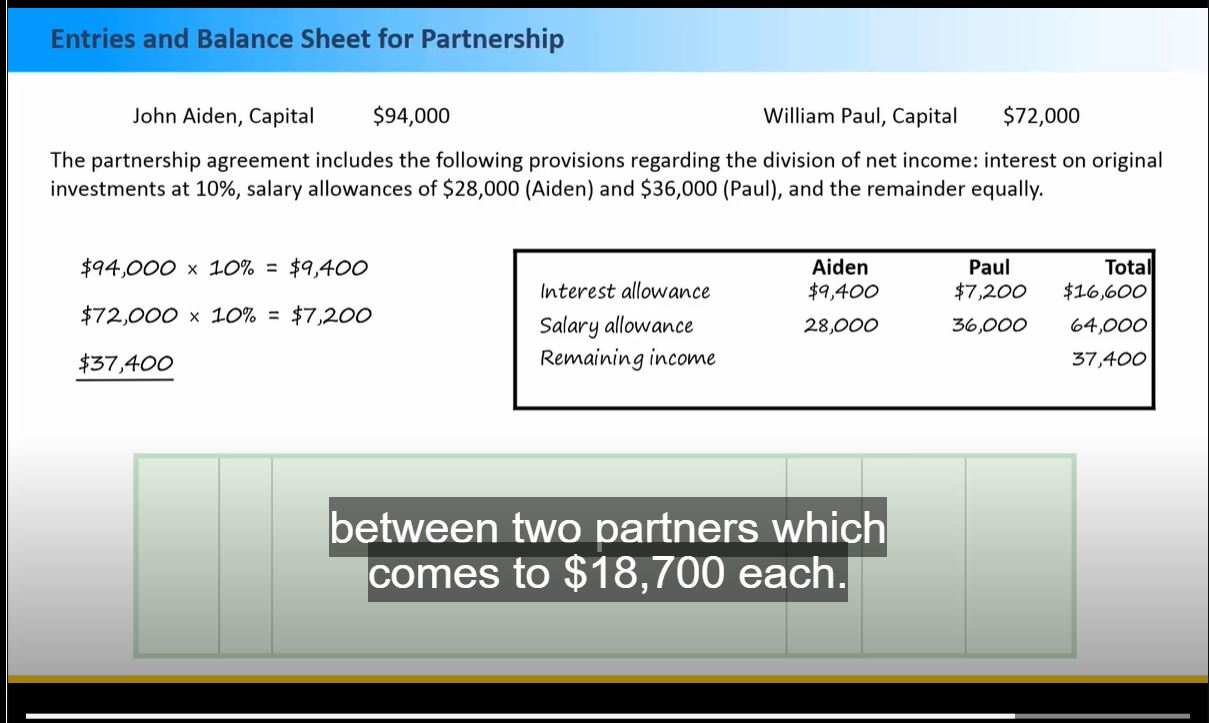

The first picture is an example and I'm not sure how they got 37,400.

Can someone please explain how they got that and how to get the two (correct) amounts that are in the red

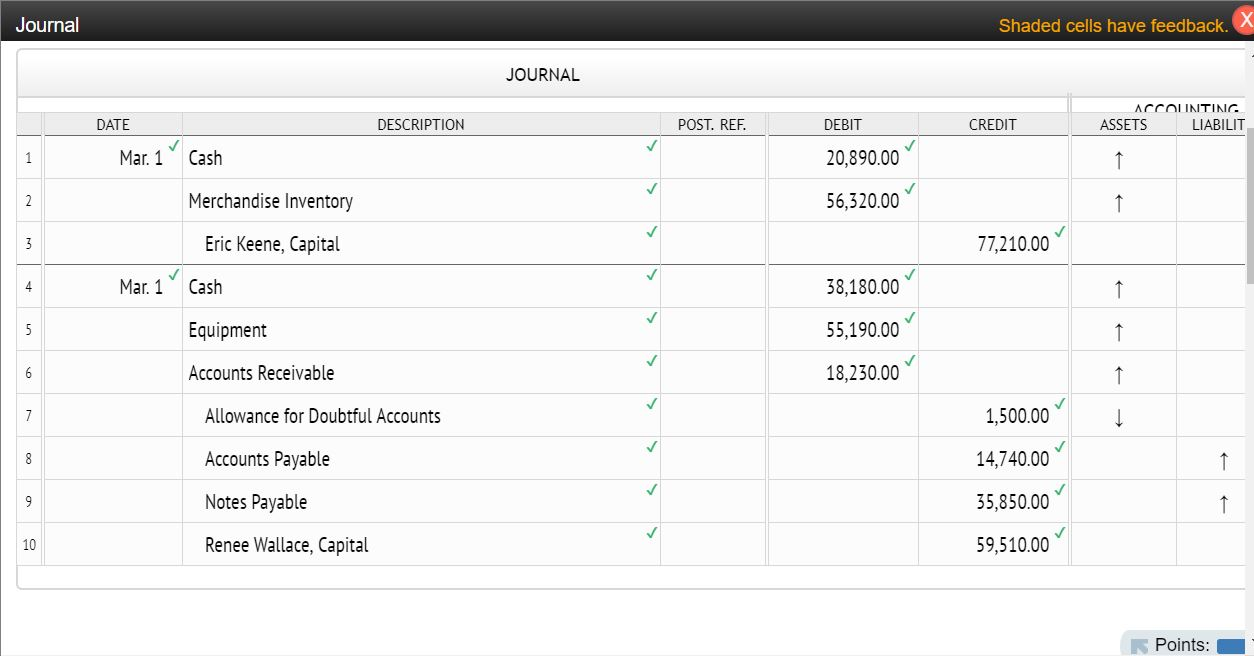

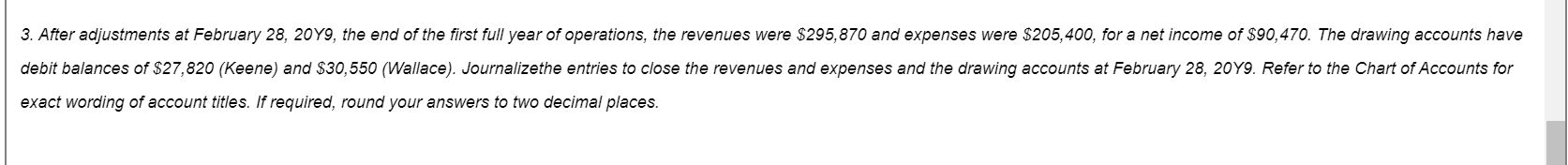

Entries and Balance Sheet for Partnership John Aiden, Capital $94,000 William Paul, Capital $72,000 The partnership agreement includes the following provisions regarding the division of net income: interest on original investments at 10%, salary allowances of $28,000 (Aiden) and $36,000 (Paul), and the remainder equally. $94,000 X 10% = $9,400 Aiden $9,400 Paul $7,200 Total $16,600 $72,000 X 10% = $7,200 Interest allowance Salary allowance Remaining income 28,000 36,000 64,000 37,400 $37,400 between two partners which comes to $18,700 each. Journal Shaded cells have feedback. JOURNAL DATE DESCRIPTION POST. REF. DEBIT CREDIT ACCOUNTING ASSETS LIABILIT 1 Mar. 1 Cash 20,890.00 1 1 2 Merchandise Inventory 56,320.00 3 Eric Keene, Capital 77,210.00 4 Mar. 1 Cash 38,180.00 5 Equipment 55,190.00 1 1 6 Accounts Receivable 18,230.00 7 Allowance for Doubtful Accounts 1,500.00 8 Accounts Payable 14,740.00 1 1 9 Notes Payable 35,850.00 10 Renee Wallace, Capital 59,510.00 Points: 3. After adjustments at February 28, 2019, the end of the first full year of operations, the revenues were $295,870 and expenses were $ 205,400, for a net income of $90,470. The drawing accounts have debit balances of $27,820 (Keene) and $30,550 ( Wallace). Journalizethe entries to close the revenues and expenses and the drawing accounts at February 28, 2049. Refer to the Chart of Accounts for exact wording of account titles. If required, round your answers to two decimal places. Journal Shaded cells have feedback. JOURNAL ACCOU ASSETS DATE DESCRIPTION POST. REF. DEBIT CREDIT Closing Entries 2 Feb. 28 Revenues 295,870.00 3 Expenses 205,400.00 4 Eric Keene, Capital 27,820.00 5 Renee Wallace, Capital 50,415.00 6 Feb. 28 Eric Keene, Capital 27,820.00 7 Renee Wallace, Capital 30,550.00 8 Eric Keene, Drawing 27,820.00 9 Renee Wallace, Drawing 30,550.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts