Question: help please, ill make sure to leave a like! Problem 5-3A Computing merchandising amounts and formatting income statements C1 P4 Valley Company's adjusted account balances

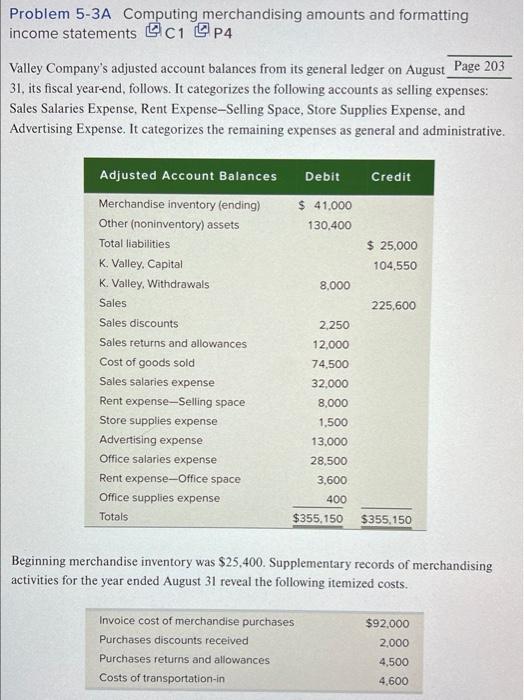

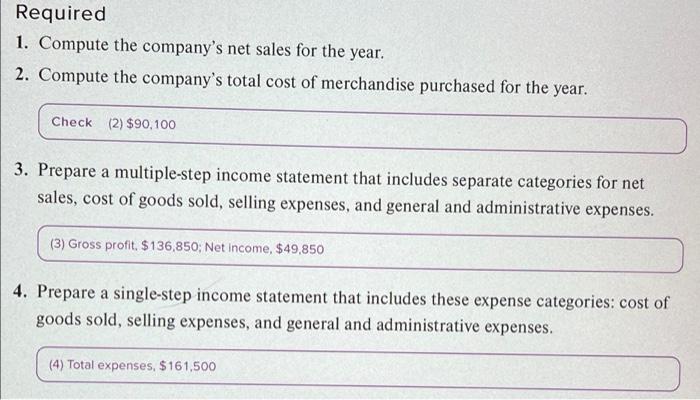

Problem 5-3A Computing merchandising amounts and formatting income statements C1 P4 Valley Company's adjusted account balances from its general ledger on August Page 203 31, its fiscal year-end, follows. It categorizes the following accounts as selling expenses: Sales Salaries Expense, Rent Expense-Selling Space, Store Supplies Expense, and Advertising Expense. It categorizes the remaining expenses as general and administrative. Debit Credit $ 41,000 130,400 $ 25,000 104,550 8,000 225,600 Adjusted Account Balances Merchandise inventory (ending) Other (noninventory) assets Total liabilities K. Valley, Capital K. Valley, Withdrawals Sales Sales discounts Sales returns and allowances Cost of goods sold Sales salaries expense Rent expense-Selling space Store supplies expense Advertising expense Office salaries expense Rent expense-Office space Office supplies expense Totals 2,250 12,000 74,500 32.000 8,000 1,500 13.000 28.500 3,600 400 $355,150 $355,150 Beginning merchandise inventory was $25,400. Supplementary records of merchandising activities for the year ended August 31 reveal the following itemized costs. $92,000 2.00 Invoice cost of merchandise purchases Purchases discounts received Purchases returns and allowances Costs of transportation in 4,500 4,600 Required 1. Compute the company's net sales for the year. 2. Compute the company's total cost of merchandise purchased for the year. Check (2) $90,100 3. Prepare a multiple-step income statement that includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses. (3) Gross profit. $136,850; Net Income, $49,850 4. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses. (4) Total expenses, $161.500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts