Question: Problem 4-3B Computing merchandising amounts and formatting income statements [ C1 P4 Barkley Company's adjusted account balances from its general ledger on March 31, its

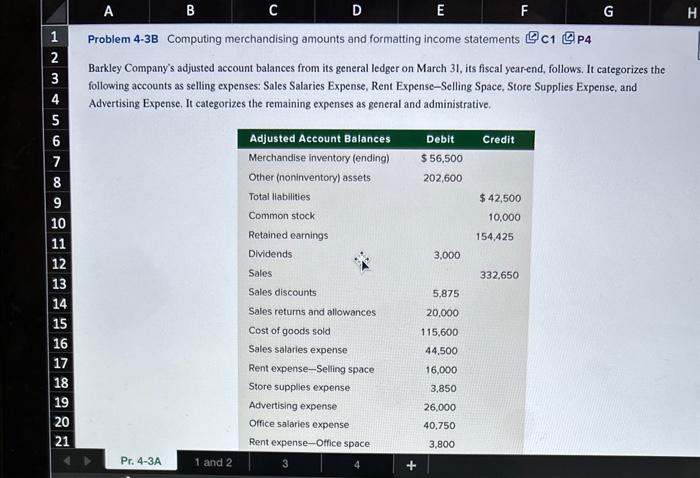

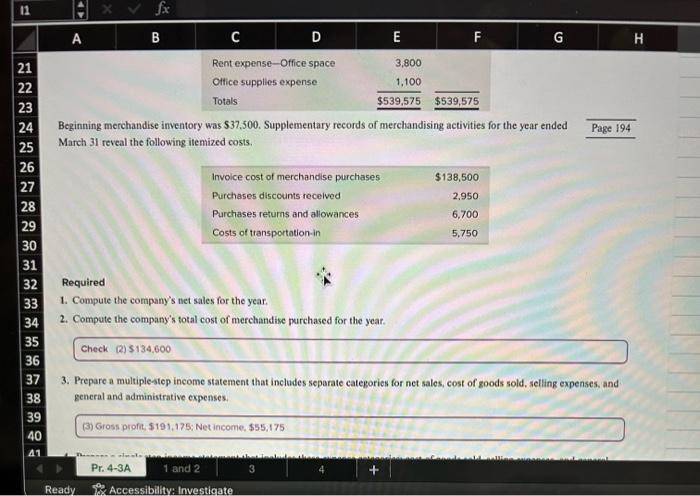

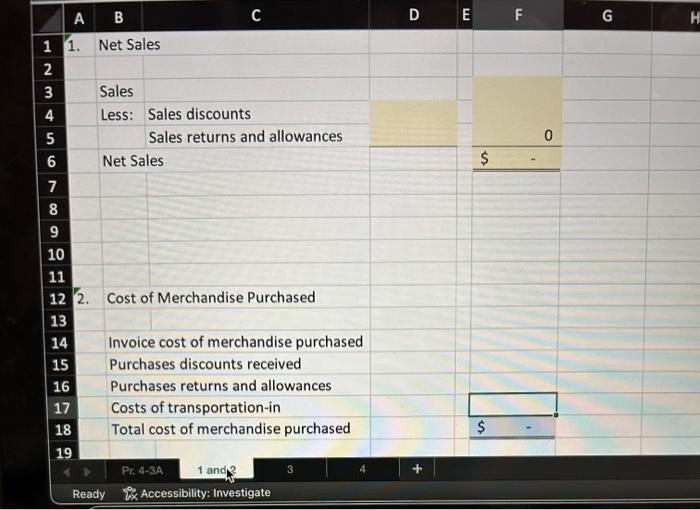

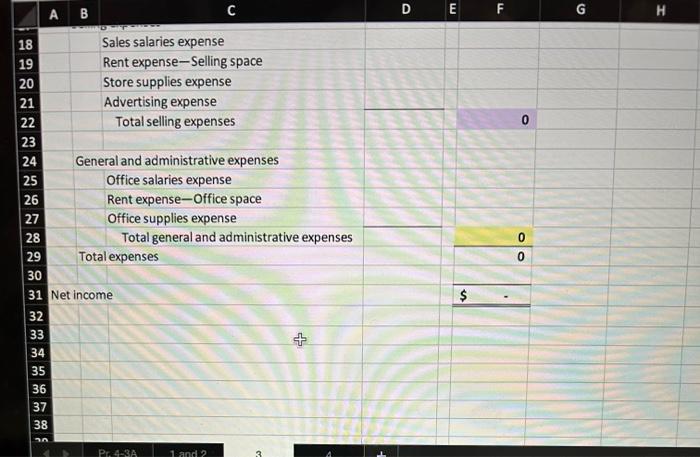

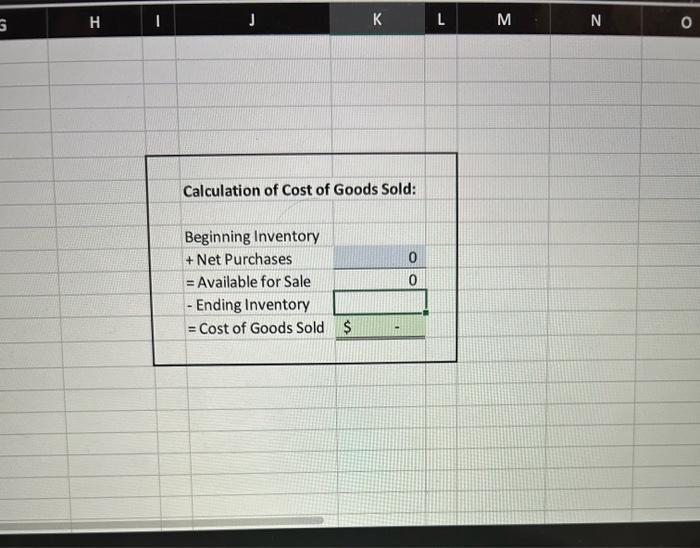

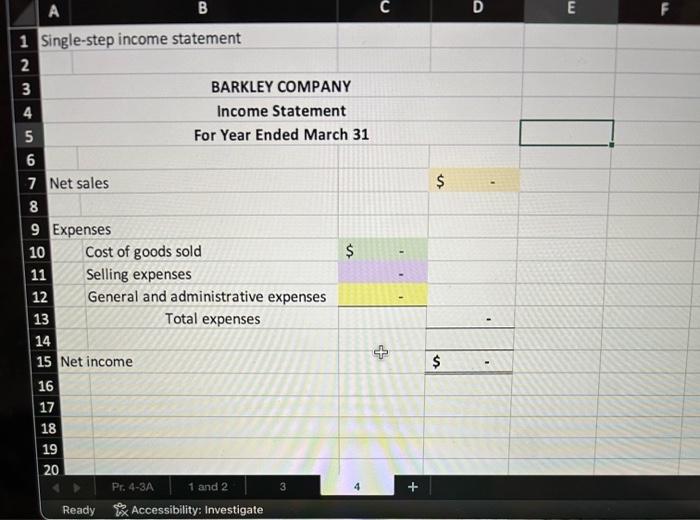

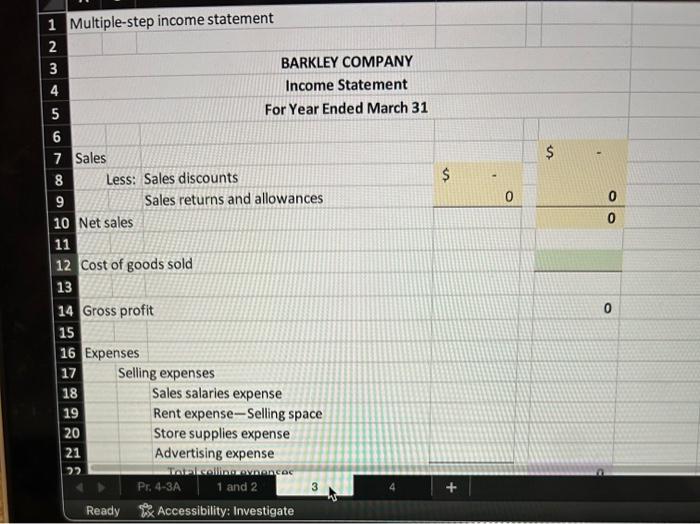

Problem 4-3B Computing merchandising amounts and formatting income statements [ C1 P4 Barkley Company's adjusted account balances from its general ledger on March 31, its fiscal yearend, follows. It categorizes the following accounts as selling expenses: Sales Salaries Expense, Rent Expense-Selling Space, Store Supplies Expense, and Advertising Expense. It categorizes the remaining expenses as general and administrative. Beginning merchandise inventory was $37,500. Supplementary records of merchandising activities for the year ended Mareh 31 reveal the following itemized costs. Required 1. Compute the company's net sales for the year. 2. Compute the company's total cost of merchandise purchased for the year. 3. Prepare a multiplestep income statement that includes separate categories for net sales, cost of goods sold, selling expenses, and general and administrative expenses. A B C D F G \begin{tabular}{|l|l|} \hline 18 & Sales salaries expense \\ \hline 19 & Rent expense-Selling space \end{tabular} Store supplies expense Advertising expense Total selling expenses General and administrative expenses Office salaries expense Rent expense-Office space Office supplies expense Total general and administrative expenses Total expenses 0 Net income $ \begin{tabular}{|l|l|} \hline & A \\ \hline 1 & Single-step income statement \\ \hline \end{tabular} BARKLEY COMPANY Income Statement For Year Ended March 31 Net sales $ Expenses Cost of goods sold Selling expenses General and administrative expenses Total expenses Net income $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts