Question: Help please!! Jenny P. Summers is the controller for Company A, a large manufacturing company. In addition to its normal business activities, the company has

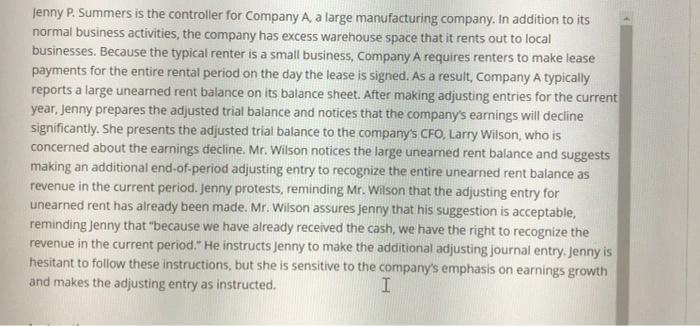

Jenny P. Summers is the controller for Company A, a large manufacturing company. In addition to its normal business activities, the company has excess warehouse space that it rents out to local businesses. Because the typical renter is a small business, Company A requires renters to make lease payments for the entire rental period on the day the lease is signed. As a result, Company A typically reports a large unearned rent balance on its balance sheet. After making adjusting entries for the current year, Jenny prepares the adjusted trial balance and notices that the company's earnings will decline significantly. She presents the adjusted trial balance to the company's CFO, Larry Wilson, who is concerned about the earnings decline. Mr. Wilson notices the large uneared rent balance and suggests making an additional end-of-period adjusting entry to recognize the entire unearned rent balance as revenue in the current period. Jenny protests, reminding Mr. Wilson that the adjusting entry for unearned rent has already been made. Mr. Wilson assures Jenny that his suggestion is acceptable, reminding Jenny that "because we have already received the cash, we have the right to recognize the revenue in the current period." He instructs Jenny to make the additional adjusting journal entry. Jenny is hesitant to follow these instructions, but she is sensitive to the company's emphasis on earnings growth and makes the adjusting entry as instructed. I 1. Is Jenny behaving ethically? Why? 2. Who is affected by Jenny's decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts