Question: help please part 1 part 2 part 3 part 4 part 5 fill the blank with (emisson tax, opportuity cost, tax bonus, or public relationship)

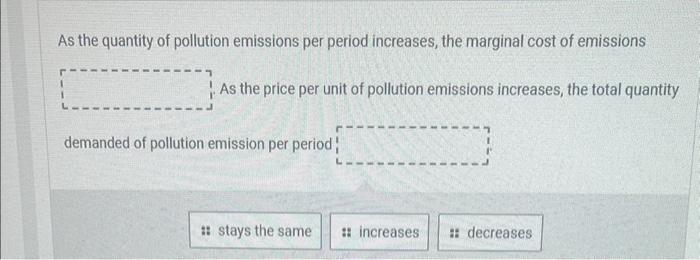

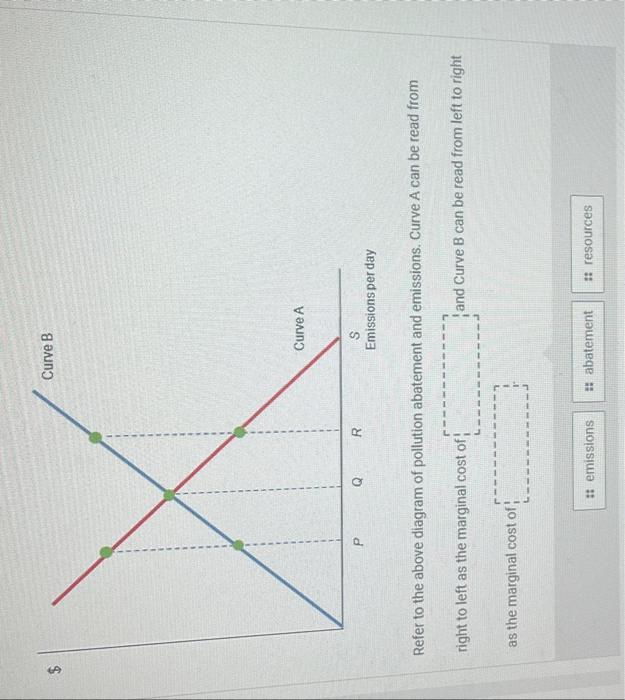

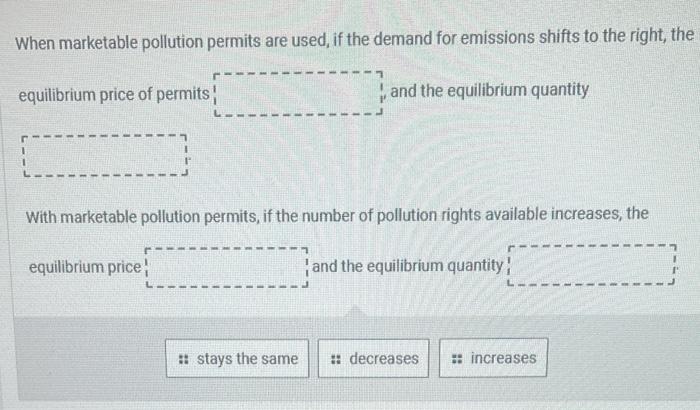

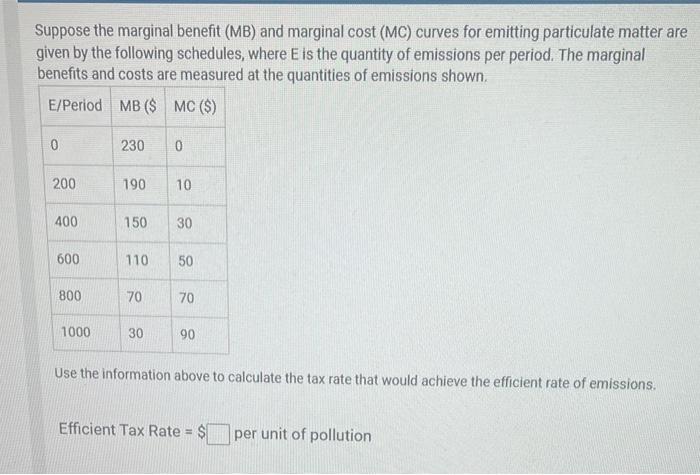

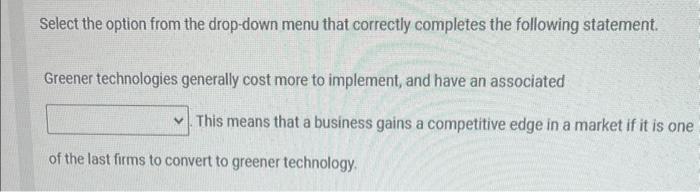

As the quantity of pollution emissions per period increases, the marginal cost of emissions As the price per unit of pollution emissions increases, the total quantity demanded of pollution emission per period Refer to the above diagram of pollution abatement and emissions. Curve A can be read from right to left as the marginal cost of and Curve B can be read from left to right as the marginal cost of When marketable pollution permits are used, if the demand for emissions shifts to the right, the equilibrium price of permits and the equilibrium quantity With marketable pollution permits, if the number of pollution rights available increases, the equilibrium price and the equilibrium quantity Suppose the marginal benefit (MB) and marginal cost (MC) curves for emitting particulate matter are given by the following schedules, where E is the quantity of emissions per period. The marginal benefits and costs are measured at the quantities of emissions shown. Use the information above to calculate the tax rate that would achieve the efficient rate of emissions. Efficient Tax Rate =$ per unit of pollution Select the option from the drop-down menu that correctly completes the following statement. Greener technologies generally cost more to implement, and have an associated This means that a business gains a competitive edge in a market if it is one of the last firms to convert to greener technology

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts