Question: help please! Question example Score: 0 of 1 pt 4 of 7 (4 completo) HW Score: 54.48%, 3.81 of 7 pts P14-11 (similar to) Question

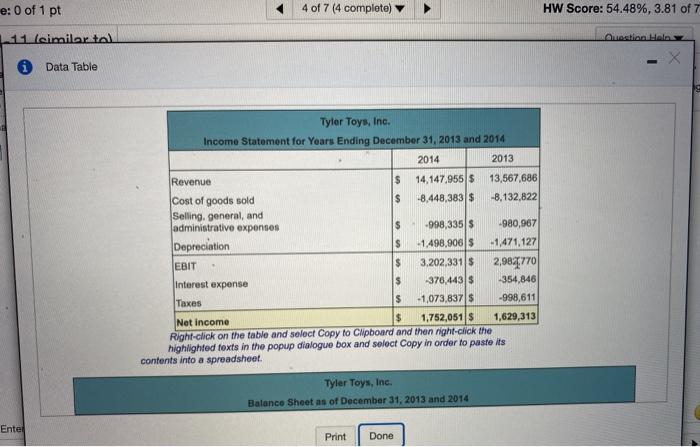

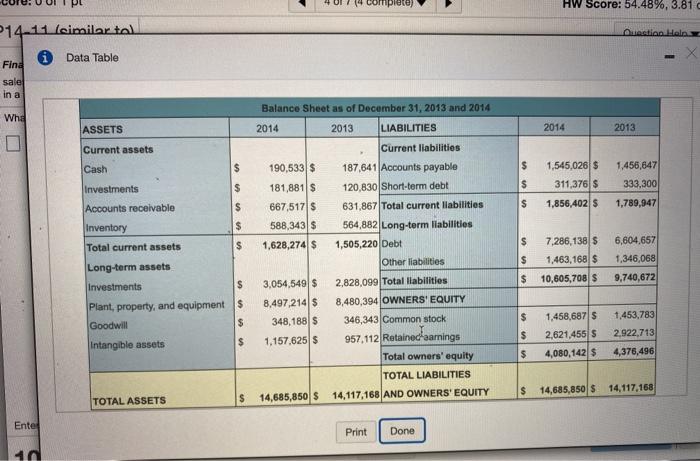

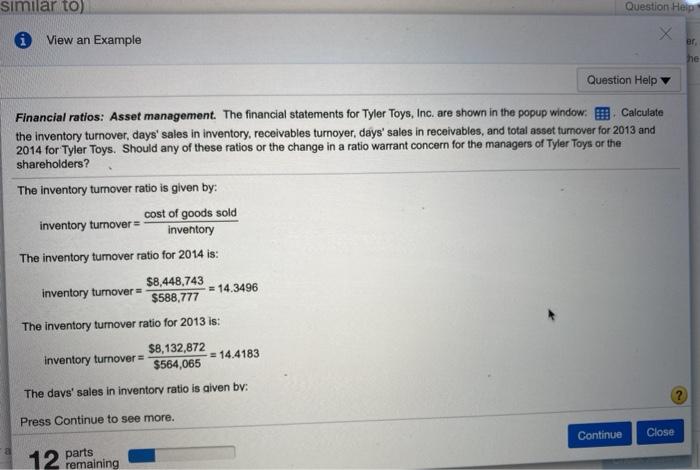

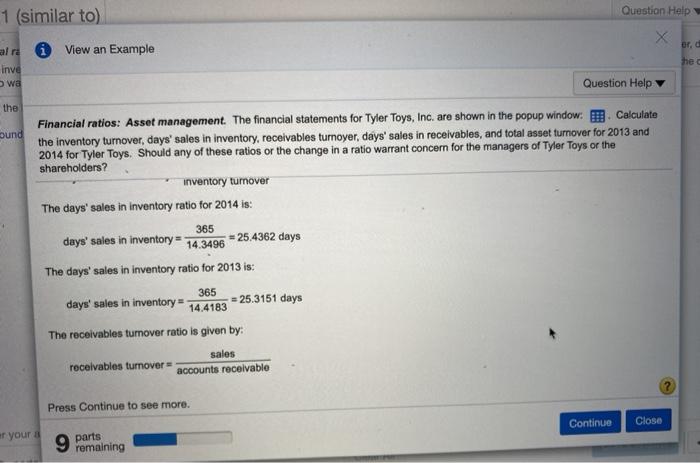

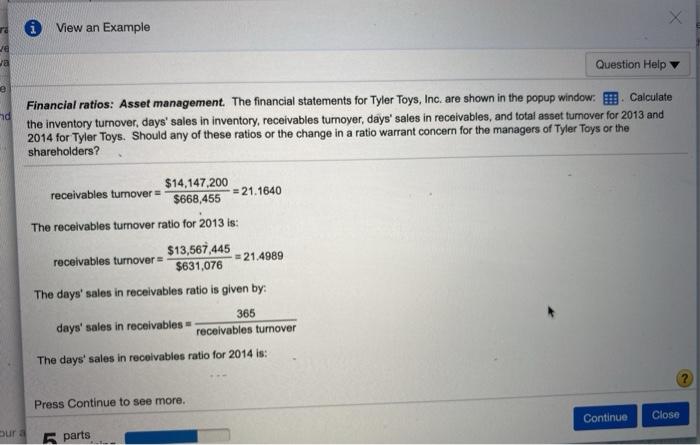

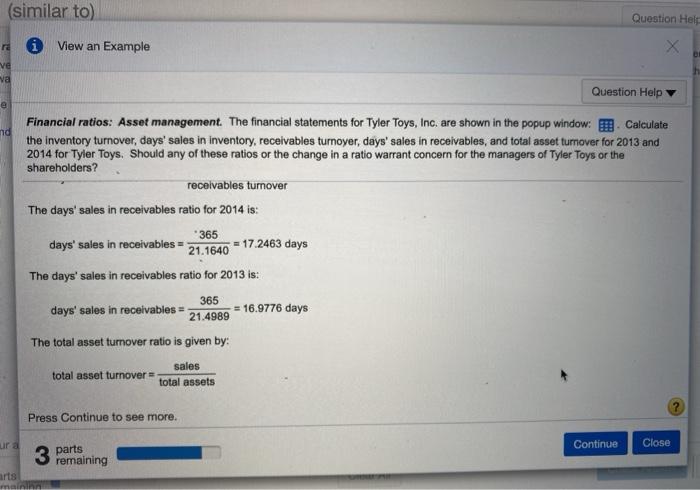

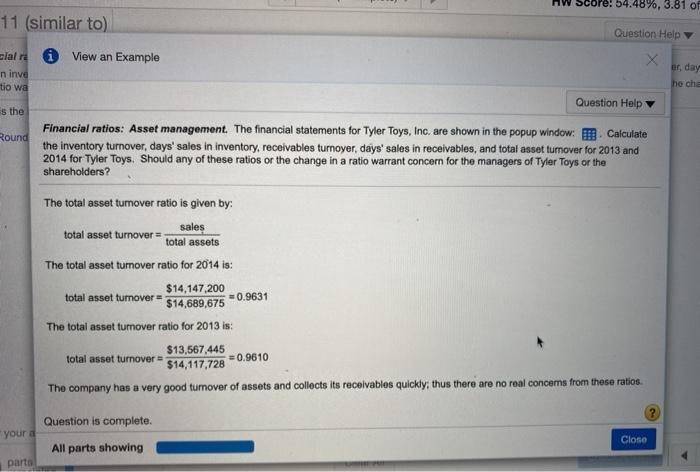

Score: 0 of 1 pt 4 of 7 (4 completo) HW Score: 54.48%, 3.81 of 7 pts P14-11 (similar to) Question Help Financial ratios: Asset management. The financial statements for Tyler Toys, Inc. are shown in the popup window. 2. Calculate the inventory turnover, days sales in Inventory, receivables tumover, days' sales in receivables, and total asset turnover for 2013 and 2014 for Tyler Toys. Should any of these ratios or the change In a ratio warrant concern for the managers of Tyler Toys or the shareholders? What is the inventory turnover ratio for 2014? (Round to four decimal places) e: 0 of 1 pt 4 of 7 (4 complete) HW Score: 54.48%, 3.81 of 7 11 Isimilar tal Gestional Data Table Tyler Toys, Inc. Income Statement for Years Ending December 31, 2013 and 2014 2014 2013 Revenue $ 14.147.955 $ 13,567,686 Cost of goods sold $ -8,448,383 $ -8,132,822 Selling, general, and administrative expenses $ 998,335 S -980,967 Depreciation $ -1,498,906 $ -1,471,127 EBIT $ 3.202,331 $ 2,984770 Interest expense $ 376,4435 354,846 Taxes $ -1,073,837 $ -998,611 Net income $ 1,752,051 $ 1,629,313 Right click on the table and select Copy to Clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its contents into a spreadsheet Tyler Toys, Inc. Balance Sheet as of December 31, 2013 and 2014 Entel Print Done HW Score: 54.48%, 3.81 Question lalo 14-11 leimilar tol i Data Table Find sale in a Whe ASSETS 2014 2013 Current assets Cash $ 1.456,647 $ $ 1,545,026 $ 311,376 $ 1,856,402 $ 333,300 $ 1,789,947 Investments $ Accounts receivable $ Inventory $ Total current assets $ Long-term assets Investments $ Plant, property, and equipment $ Goodwill $ Intangible assets $ Balance Sheet as of December 31, 2013 and 2014 2014 2013 LIABILITIES Current liabilities 190,533 $ 187,641 Accounts payable 181,881 $ 120,830 Short-term debt 667,5171 $ 631,867 Total current liabilities 588,343 $ 564,882 Long-term liabilities 1,628,274 $ 1,505,220 Debt Other liabilities 3,054,549 $ 2,828,099 Total liabilities 8,497,214 $ 8,480,394 OWNERS' EQUITY 348,188 $ 346,343 Common stock 1,157,625 $ 957,112 Retained earnings Total owners' equity TOTAL LIABILITIES 14,685,850 S 14,117,168 AND OWNERS' EQUITY $ 7,286,138$ $ 1,463,168 $ $ 10,605,708 $ 6,604,657 1,346,068 9,740,672 $ 1,453,783 2,922,713 1,458,687 5 2,621,455 S 4,080,142 $ $ $ 4,376,496 $ 14,685,850 $ 14,117,168 TOTAL ASSETS S Ented Print Done similar to) Question Help View an Example er he Question Help Financial ratios: Asset management. The financial statements for Tyler Toys, Inc. are shown in the popup window... Calculate the inventory turnover, days' sales in inventory, receivables turnoyer, days' sales in receivables, and total asset turnover for 2013 and 2014 for Tyler Toys. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? The inventory turnover ratio is given by: cost of goods sold inventory turnover inventory The inventory tumover ratio for 2014 is: $8,448,743 inventory turnover = = 14.3496 $588,777 The inventory turnover ratio for 2013 is: $8,132,872 inventory turnover = $564,065 -= 14.4183 The days' sales in inventory ratio is given by: Press Continue to see more. Continue Close 12 parts remaining Question Help 1 (similar to) X i View an Example hec inve wa Question Help the und Financial ratios: Asset management. The financial statements for Tyler Toys, Inc. are shown in the popup window: . Calculate the inventory turnover, days' sales in inventory, receivables turnoyer, days' sales in receivables, and total asset turnover for 2013 and 2014 for Tyler Toys Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? inventory turnover The days' sales in inventory ratio for 2014 is: 365 days' sales in inventory = = 25.4362 days 14.3496 The days' sales in inventory ratio for 2013 is: 365 days' sales in inventory 14.4183 = 25.3151 days The receivables turnover ratio is given by: sales receivables turnover accounts receivable Press Continue to see more. Continue Close er your 9 parts remaining View an Example ve Ja Question Help d Financial ratios: Asset management. The financial statements for Tyler Toys, Inc. are shown in the popup window: . Calculate the inventory turnover, days' sales in inventory, receivables tumoyer, days' sales in receivables, and total asset turnover for 2013 and 2014 for Tyler Toys. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? $14,147,200 receivables turnover $668,455 = 21.1640 The receivables turnover ratio for 2013 is: $13,567,445 receivables turnover 21.4989 $631,076 The days' sales in receivables ratio is given by: 365 days' sales in receivables receivables turnover The days' sales in receivables ratio for 2014 is: Press Continue to see more. Continue Close bura parts (similar to) Question Help i View an Example ve va Question Help e nd Financial ratios: Asset management. The financial statements for Tyler Toys, Inc. are shown in the popup window: Calculate the inventory turnover, days' sales in inventory, receivables turnoyer, days' sales in receivables, and total asset turnover for 2013 and 2014 for Tyler Toys. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? receivables turnover The days' sales in receivables ratio for 2014 is: 365 days' sales in receivables = 21.1640 = 17.2463 days The days' sales in receivables ratio for 2013 is: 365 days' sales in receivables = 21.4989 = 16.9776 days The total asset turnover ratio is given by: sales total asset turnover = total assets Press Continue to see more. ura Continue Close 3 Pemaining arts Score: 54.48%, 3.81 of 11 (similar to) Question Help i View an Example ciale n inve tio wa er, day he che Question Help s the Round Financial ratios: Asset management. The financial statements for Tyler Toys, Inc. are shown in the popup window: Calculate the inventory turnover, days' sales in inventory, receivables turnoyer, days' sales in receivables, and total asset tumover for 2013 and 2014 for Tyler Toys. Should any of these ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? The total asset tumover ratio is given by: total asset turnover = sales total assets The total asset turnover ratio for 2014 is: $14,147,200 total asset turnover = = 0.9631 $14,689,675 The total asset turnover ratio for 2013 is: $13,567,445 total asset turnover = =0.9610 $14,117,728 The company has a very good turnover of assets and collects its receivables quickly, thus there are no real concerns from these ratios 2 your Question is complete All parts showing Close parto

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts