Question: Help, please QUESTION The balance sheet and income statement data for XYZ Corporation appear below. (Time: 35-40 minutes) XYZ INC. Balance Sheets December 31,2020 2020

Help, please

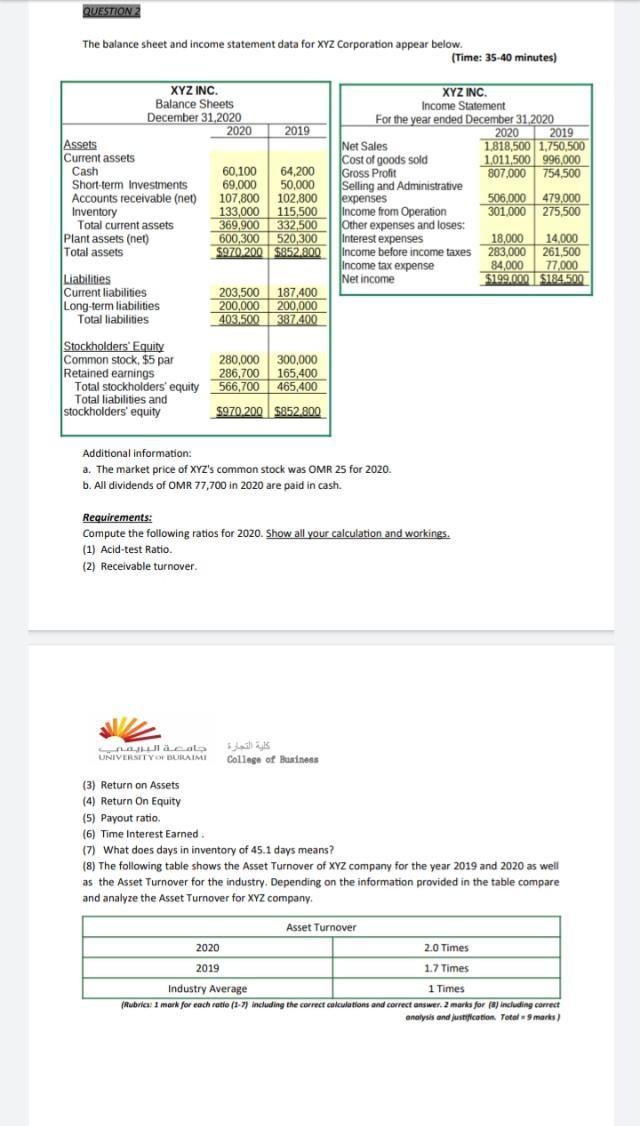

QUESTION The balance sheet and income statement data for XYZ Corporation appear below. (Time: 35-40 minutes) XYZ INC. Balance Sheets December 31,2020 2020 2019 Assets Current assets Cash 60,100 64,200 Short-term Investments 69.000 50,000 Accounts receivable (net) 107,800 102,800 Inventory 133,000 115,500 Total current assets 369,900 332,500 Plant assets (net) 600,300 520,300 Total assets $970.2005852.800 XYZ INC. Income Statement For the year ended December 31, 2020 2020 2019 Net Sales 1,818,500 1,750,500 Cost of goods sold 1,011,500 996,000 Gross Profit 807,000 754,500 Selling and Administrative expenses 506,000 479,000 Income from Operation 301.000 275,500 Other expenses and loses: Interest expenses 18,000 14,000 Income before income taxes 283,000 261,500 Income tax expense 84,000 77,000 INet income $199,000 $184.500 Liabilities Current liabilities Long-term liabilities Total liabilities 203,500 187,400 200,000 200,000 403,500 387.400 Stockholders' Equity Common stock, $5 par 280,000 300,000 Retained earnings 286,700 165,400 Total stockholders' equity 566,700 465,400 Total liabilities and stockholders' equity $970.200 S852.800 Additional information: a. The market price of XYZ's common stock was OMR 25 for 2020. b. All dividends of OMR 77,700 in 2020 are paid in cash. Requirements: Compute the following ratios for 2020. Show all your calculation and workings. (1) Acid-test Ratio (2) Receivable turnover. UNIVERSITY BURAIMI College of Business (3) Return on Assets (4) Return On Equity 4 (5) Payout ratio (6) Time Interest Earned (7) What does days in inventory of 45.1 days means? (8) The following table shows the Asset Turnover of XYZ company for the year 2019 and 2020 as well as the Asset Turnover for the industry. Depending on the information provided in the table compare and analyze the Asset Turnover for XYZ company, Asset Turnover 2020 2.0 Times 2019 1.7 Times Industry Average 1 Times Rubrica: 1 mark for each ratlo (1-7) including the correct calculations and correct answer. 2 marka for faj including correct analysis and justification. Total marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts