Question: HELP PLEASE !! Review the Globe to determine Baldwin's current strategy. How will they seek a competitive advantage? From the following list, select the top

HELP PLEASE !!

Review the Globe to determine Baldwin's current strategy. How will they seek a competitive advantage? From the following list, select the top five sources of competitive advantage that Baldwin would be most likely to pursue. -Offer attractive credit terms. -Seek the lowest price in their target market while maintaining a competitive contribution margin. -Seek high automation levels. -Accept lower plant utilization and higher plant capacity to ensure sufficient capacity is available to meet demand. -Outsource units to meet additional demand. -Tailor products to specific global regions. -Seek excellent product designs, high awareness, and high accessibility. -Seek high plant utilization, even if it risks occasional small stock outs.

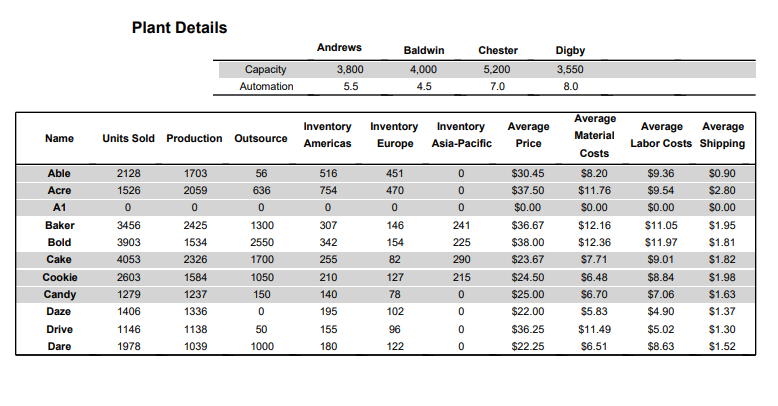

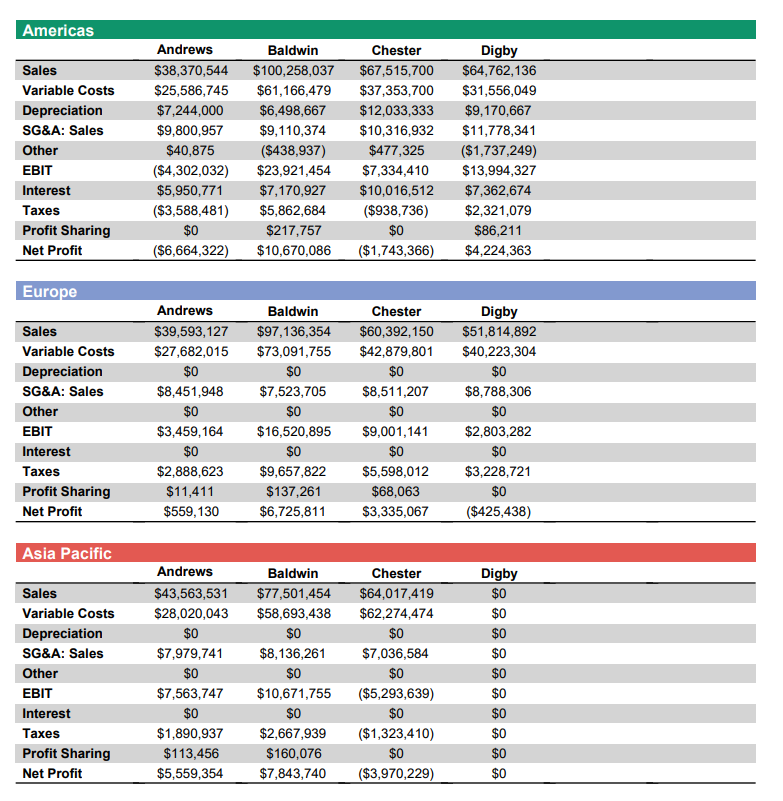

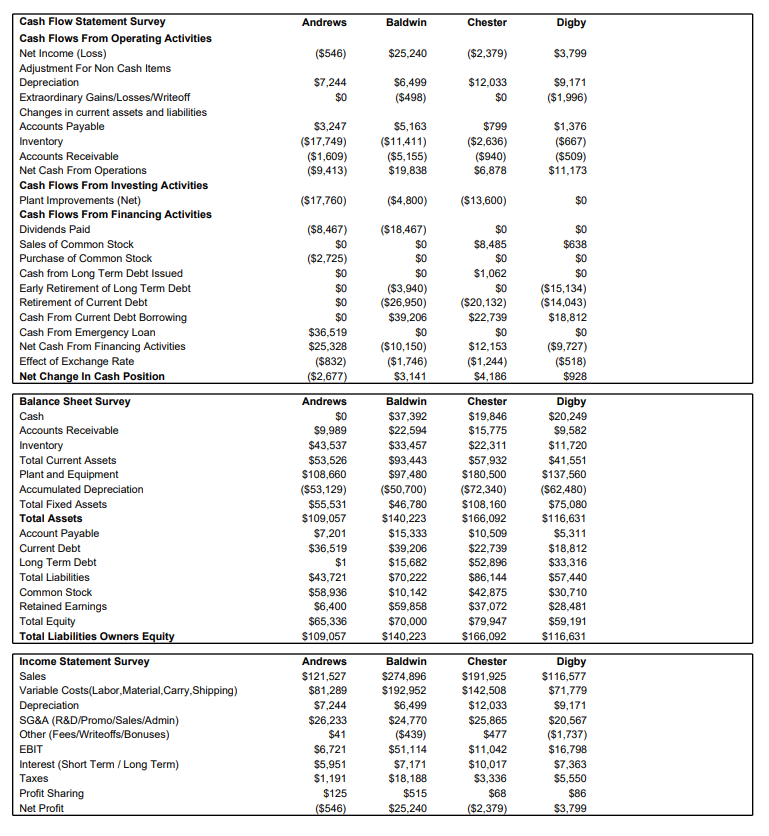

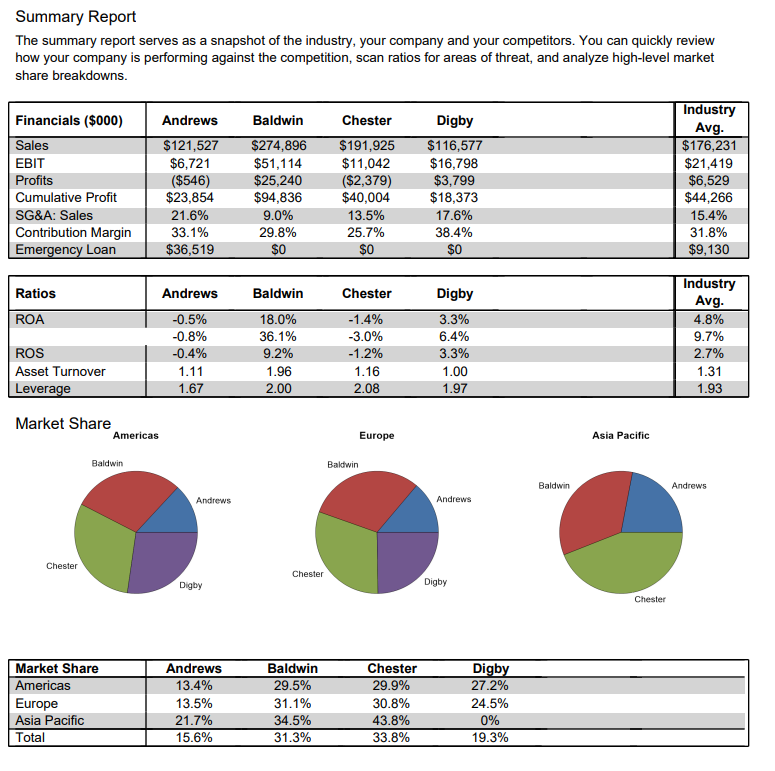

Plant Details \begin{tabular}{lcccc} \hline & & & & \\ Americas & Andrews & Baldwin & Chester & Digby \\ \hline Sales & $38,370,544 & $100,258,037 & $67,515,700 & $64,762,136 \\ Variable Costs & $25,586,745 & $61,166,479 & $37,353,700 & $31,556,049 \\ Depreciation & $7,244,000 & $6,498,667 & $12,033,333 & $9,170,667 \\ SG\&A: Sales & $9,800,957 & $9,110,374 & $10,316,932 & $11,778,341 \\ Other & $40,875 & ($438,937) & $477,325 & ($1,737,249) \\ EBIT & ($4,302,032) & $23,921,454 & $7,334,410 & $13,994,327 \\ Interest & $5,950,771 & $7,170,927 & $10,016,512 & $7,362,674 \\ Taxes & ($3,588,481) & $5,862,684 & ($938,736) & $2,321,079 \\ Profit Sharing & $0 & $217,757 & $0 & $86,211 \\ \hline Net Profit & ($6,664,322) & $10,670,086 & ($1,743,366) & $4,224,363 \\ \hline \end{tabular} \begin{tabular}{lcccc} Europe & & & & \\ & Andrews & Baldwin & Chester & Digby \\ \hline Sales & $39,593,127 & $97,136,354 & $60,392,150 & $51,814,892 \\ Variable Costs & $27,682,015 & $73,091,755 & $42,879,801 & $40,223,304 \\ Depreciation & $0 & $0 & $0 & $0 \\ SG\&A: Sales & $8,451,948 & $7,523,705 & $8,511,207 & $8,788,306 \\ Other & $0 & $0 & $0 & $0 \\ EBIT & $3,459,164 & $16,520,895 & $9,001,141 & $2,803,282 \\ Interest & $0 & $0 & $0 & $0 \\ Taxes & $2,888,623 & $9,657,822 & $5,598,012 & $3,228,721 \\ Profit Sharing & $11,411 & $137,261 & $68,063 & $0 \\ \hline Net Profit & $559,130 & $6,725,811 & $3,335,067 & ($425,438) \\ \hline & & & & \end{tabular} \begin{tabular}{lcccc} Asia Pacific & & & & \\ & Andrews & Baldwin & Chester & Digby \\ \hline Sales & $43,563,531 & $77,501,454 & $64,017,419 & $0 \\ Variable Costs & $28,020,043 & $58,693,438 & $62,274,474 & $0 \\ Depreciation & $0 & $0 & $0 & $0 \\ SG\&A: Sales & $7,979,741 & $8,136,261 & $7,036,584 & $0 \\ Other & $0 & $0 & $0 & $0 \\ EBIT & $7,563,747 & $10,671,755 & ($5,293,639) & $0 \\ Interest & $0 & $0 & $0 & $0 \\ Taxes & $1,890,937 & $2,667,939 & ($1,323,410) & $0 \\ Profit Sharing & $113,456 & $160,076 & $0 & $0 \\ \hline Net Profit & $5,559,354 & $7,843,740 & ($3,970,229) & $0 \\ \hline \end{tabular} Summary Report The summary report serves as a snapshot of the industry, your company and your competitors. You can quickly review how your company is performing against the competition, scan ratios for areas of threat, and analyze high-level market share breakdowns. Markot Charo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts