Question: Help! please show how to do the problem. If a financial calculator can be used, please show how. thank you Bond prices and yields Assume

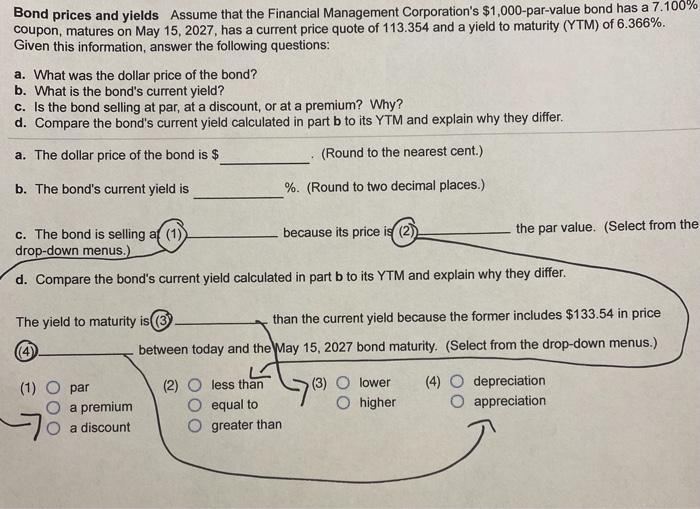

Bond prices and yields Assume that the Financial Management Corporation's $1,000-par-value bond has a 7.100% coupon, matures on May 15, 2027, has a current price quote of 113.354 and a yield to maturity (YTM) of 6.366%. Given this information, answer the following questions: a. What was the dollar price of the bond? b. What is the bond's current yield? c. Is the bond selling at par, at a discount, or at a premium? Why? d. Compare the bond's current yield calculated in part b to its YTM and explain why they differ. a. The dollar price of the bond is $ (Round to the nearest cent.) b. The bond's current yield is %. (Round to two decimal places.) because its price is (2) the par value. (Select from the c. The bond is selling af (1) drop-down menus.) d. Compare the bond's current yield calculated in part b to its YTM and explain why they differ. The yield to maturity is (3) than the current yield because the former includes $133.54 in price between today and the May 15, 2027 bond maturity. (Select from the drop-down menus.) (2) (3) (1) O par a premium O a discount less than equal to greater than lower higher (4) O depreciation O appreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts