Question: help! please show how to do the problem. If a financial calculator can be used, please show how. thank you Yield to maturity. The bond

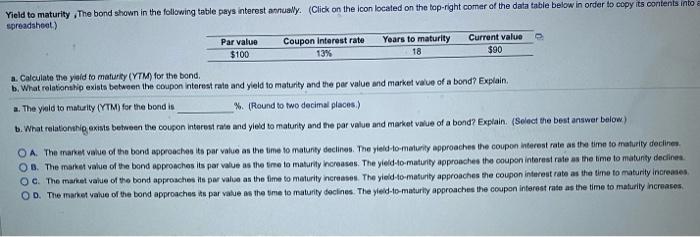

Yield to maturity. The bond shown in the following table pays interest annually. (Click on the icon located on the top-right comer of the data table below in order to copy its contents into spreadsheet) Par value $100 Coupon Interest rate 13% Years to maturity 18 Current value $90 a. Calculate the yield to maturity (YTM) for the bond. b. What relationship exists between the coupon Interest rate and yield to maturity and the par value and market value of a bond? Explain a. The yield to maturity (YTM) for the bond is %. (Round to wo decimal plnous.) b. What relationshigoxins between the coupon Interest rate and yield to maturity and the par value and market value of a bond? Explain. (Select the best answer below) O A The market value of the bond approaches its par value as the time to maturity declines. The yield to matury approaches the coupon Interest rate as the time to maturity declines OB. The market value of the bond approaches its par value as the time to maturity increases. The yield-to maturity approaches the coupon interest rate as the time to matunty declines OG The market value of the bond approaches its par value as the time to maturity increases. The yield-to-maturity approaches the coupon interest rate as the time to maturity increases OD. The market value of the bond approaches its par value as the time to maturity declines. The yield-to-maturly approaches the coupon interest rate as the time to maturity increases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts