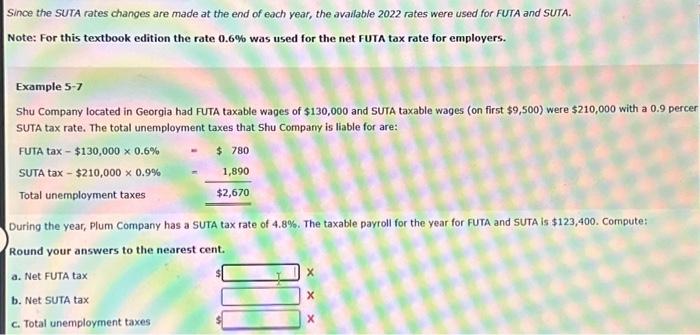

Question: help please. Since the SUTA rates changes are made at the end of each year, the available 2022 rates were used for FUTA and SUTA.

Since the SUTA rates changes are made at the end of each year, the available 2022 rates were used for FUTA and SUTA. Note: For this textbook edition the rate 0.6% was used for the net FuTA tax rate for employers. Example 5-7 Shu Company located in Georgia had FUTA taxable wages of $130,000 and SUTA taxable wages (on first $9,500 ) were $210,000 with a 0.9 perce SUTA tax rate. The total unemployment taxes that Shu Company is liable for are: During the year, Plum Company has a SUTA tax rate of 4.8%. The taxable payroll for the year for FUTA and SUTA is $123,400. Compute: Round your answers to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts