Question: i need part one and two please Since the SUTA rates changes are made at the end of each year, the available 2022 rates were

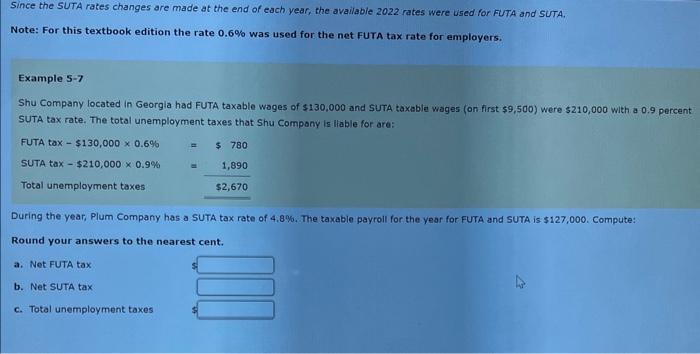

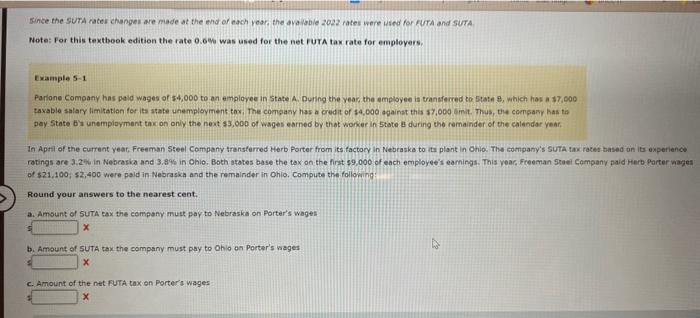

Since the SUTA rates changes are made at the end of each year, the available 2022 rates were wsed for FUTA and SUTA. Note: For this textbook edition the rate 0.6% was used for the net FUTA tax rate for employers. Example 5-7 Shu Company located in Georgia had FUTA taxable wages of $130,000 and 5UTA taxable wages (on first $9,500) were $210,000 with a 0.9 percent SUTA tax rate. The total unemployment taxes that Shu Compony is llable for are: During the year; Plum Company has a SUTA tax rate of 4,8\%. The taxable payroll for the year for FUTA and SUTA is $127,000. Compute: Round your answers to the nearest cent. Fince the sUTA rater changes we made at the end or eash yoar, the avalabie 2022 rates were usnd for fuTA and suTA. Note: For this textbeok edition the rate 0.6Fe was used for the net fuTA tax rate for employers. Example 5-1 Parione Company has paid wages of s4,000 to an employee in state A. Dyring the year, the amployee is transferred to 5 tate 8, which has a 17,000 tavable salary limitatian for ita atate unemployintent tor, The company has a gredt of 44,000 againat thas 47,000 int. Thus, the coencany has ta pay State by unempioymant tax on ony the neat $3,000 of wages earned by thot worker in 5 tote 8 during the remainder of the calendar year. In Aptil of the current year, Freeman Steel Company transferred Herb Porter from its factocy in Nebraska to ita plant in onio. The eompany's Suta tax rates based an its experience rotings are 3.2k in Nebcaska and 3.89 in Ohio, Both atates base the tax on the first 59.090 of each employee's eamings. This year, Fceeman 5zaei Campany paid Herb. Parter nages of 521,100;52,400 were paid in Nebraska and the remainder in ohio. Compute the followind: Round your answers to the nearest cent. a. Amsunt of 5 A ta tax the company must pay to Nebraska on Porter's wage: x b. Amount of SUTA tax the company must pay to Ohio on Porter's nages x . Amount of the net fUTA tax on Porters wages x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts