Question: help please Smithson Mining operates a siver mine in Nevada. Acquisition, exploration, and development costs totaled $5.6 milion. After the silver is extracted in approximately

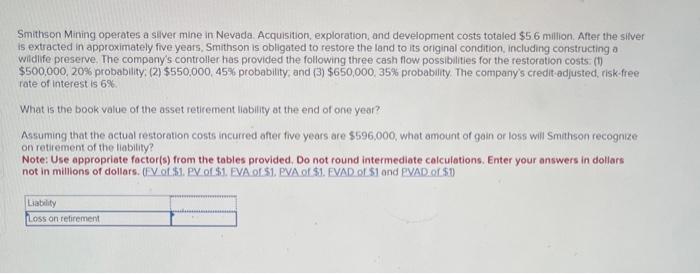

Smithson Mining operates a siver mine in Nevada. Acquisition, exploration, and development costs totaled $5.6 milion. After the silver is extracted in approximately five years, Smithson is obligated to restore the land to its original condition, including constructing a widife preserve, The company's controller has provided the following three cash flow possibilities for the restoration costs. (t) $500,000,20% probability: (2) $550,000,45% probability, and (3) $650,000,35% probability. The company's credit adjusted, risk-free rate of interest is 6% What is the book value of the asset retirement liability at the end of one year? Assuming that the actual restoration costs incurred after five years are $596,000, what amount of gain or loss will Smathson recognize on retirement of the liability? Note: Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Enter your answers in dollars not in millions of dollars. (FV of \$1. PV of \$1. EVA or S1. PVA of S1. EVAD of S1 and PVAD or S1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts