Question: help please use formula and show how done in excel if possible Hank is 25 years old and has just started his first big people

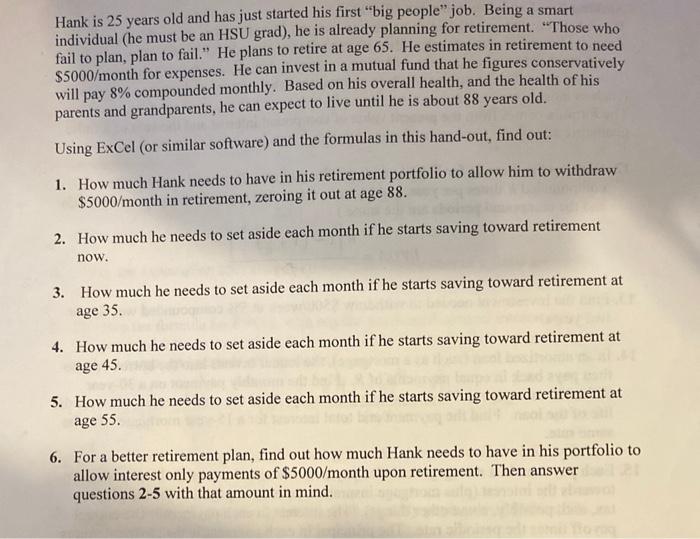

Hank is 25 years old and has just started his first "big people" job. Being a smart individual (he must be an HSU grad), he is already planning for retirement. "Those who fail to plan, plan to fail." He plans to retire at age 65. He estimates in retirement to need $5000/month for expenses. He can invest in a mutual fund that he figures conservatively will pay 8% compounded monthly. Based on his overall health, and the health of his parents and grandparents, he can expect to live until he is about 88 years old. Using ExCel (or similar software) and the formulas in this hand-out, find out: 1. How much Hank needs to have in his retirement portfolio to allow him to withdraw $5000/month in retirement, zeroing it out at age 88. 2. How much he needs to set aside each month if he starts saving toward retirement now. 3. How much he needs to set aside each month if he starts saving toward retirement at age 35. 4. How much he needs to set aside each month if he starts saving toward retirement at age 45. 5. How much he needs to set aside each month if he starts saving toward retirement at age 55. 6. For a better retirement plan, find out how much Hank needs to have in his portfolio to allow interest only payments of $5000/month upon retirement. Then answer questions 2-5 with that amount in mind

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts