Question: help please Valley Construction's owner bought his current equipment two years ago for $12,000, and it has one more year of life remaining. Valley is

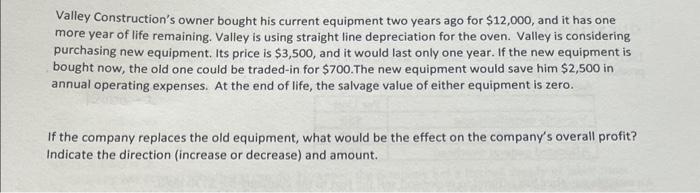

Valley Construction's owner bought his current equipment two years ago for $12,000, and it has one more year of life remaining. Valley is using straight line depreciation for the oven. Valley is considering purchasing new equipment. Its price is $3,500, and it would last only one year. If the new equipment is bought now, the old one could be traded-in for $700. The new equipment would save him $2,500 in annual operating expenses. At the end of life, the salvage value of either equipment is zero. If the company replaces the old equipment, what would be the effect on the company's overall profit? Indicate the direction (increase or decrease) and amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts