Question: help pls try to answer all thx u Question 4 of 20 -/ 55 View Policies Current Attempt in Progress Caine Bottling Corporation is considering

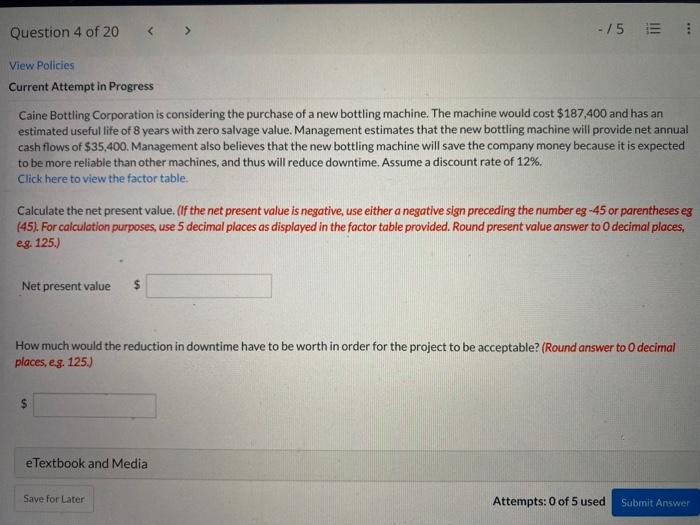

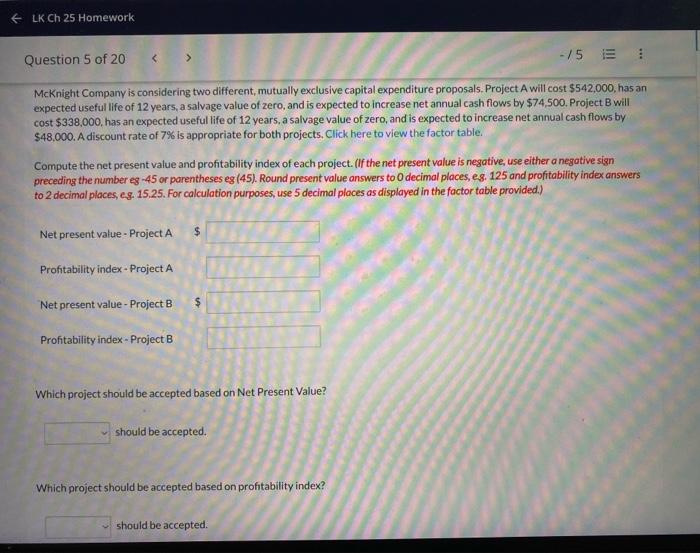

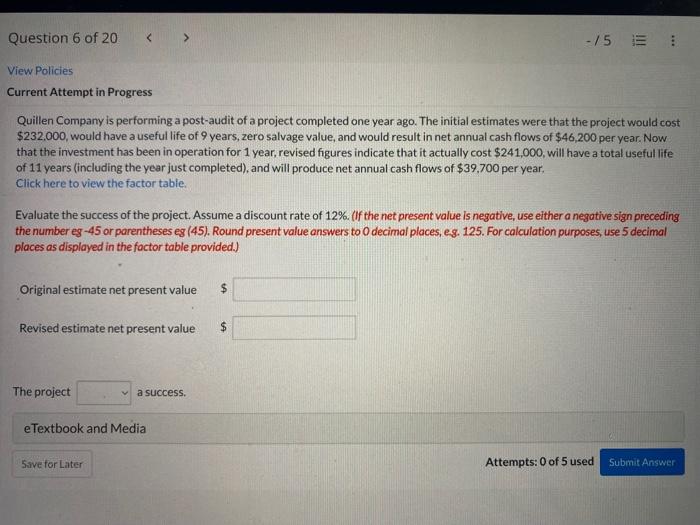

Question 4 of 20 -/ 55 View Policies Current Attempt in Progress Caine Bottling Corporation is considering the purchase of a new bottling machine. The machine would cost $187,400 and has an estimated useful life of 8 years with zero salvage value. Management estimates that the new bottling machine will provide net annual cash flows of $35,400. Management also believes that the new bottling machine will save the company money because it is expected to be more reliable than other machines, and thus will reduce downtime. Assume a discount rate of 12%. Click here to view the factor table. Calculate the net present value. (If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round present value answer to decimal places, eg. 125.) Net present value $ How much would the reduction in downtime have to be worth in order for the project to be acceptable? (Round answer to decimal places, eg. 125.) e Textbook and Media Save for Later Attempts: 0 of 5 used Submit Answer LK Ch 25 Homework Question 5 of 20 - /5 E McKnight Company is considering two different, mutually exclusive capital expenditure proposals. Project A will cost $542,000, has an expected useful life of 12 years, a salvage value of zero, and is expected to increase net annual cash flows by $74,500. Project B will cost $338,000, has an expected useful life of 12 years, a salvage value of zero, and is expected to increase net annual cash flows by $48.000. A discount rate of 7% is appropriate for both projects. Click here to view the factor table. Compute the net present value and profitability index of each project. (If the net present value is negative, use either a negative sign preceding the number es -45 or parentheses eg (45). Round present value answers to decimal places, eg, 125 and profitability Index answers to 2 decimal places, eg. 15.25. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Net present value - Project A $ Profitability index - Project A Net present value - Project B $ Profitability index - Project B Which project should be accepted based on Net Present Value? should be accepted. Which project should be accepted based on profitability index? should be accepted Question 6 of 20 -/5 View Policies Current Attempt in Progress Quillen Company is performing a post-audit of a project completed one year ago. The initial estimates were that the project would cost $232,000, would have a useful life of 9 years, zero salvage value and would result in net annual cash flows of $46,200 per year. Now that the investment has been in operation for 1 year, revised figures indicate that it actually cost $241,000, will have a total useful life of 11 years (including the year just completed), and will produce net annual cash flows of $39,700 per year. Click here to view the factor table. Evaluate the success of the project. Assume a discount rate of 12%. (If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). Round present value answers to decimal places, eg. 12 For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Original estimate net present value $ Revised estimate net present value $ The project a success. e Textbook and Media Save for Later Attempts: 0 of 5 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts