Question: HELP Problem 1 18 Attempt 1/5 for 10 pts. Part 1 A European call and a European put option have the same underlying stock, strike

HELP

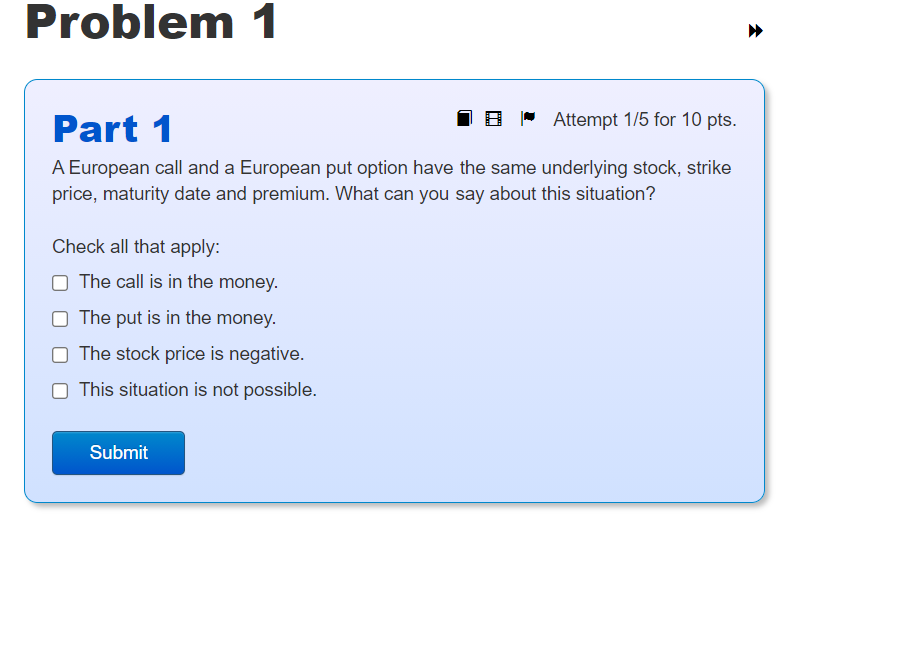

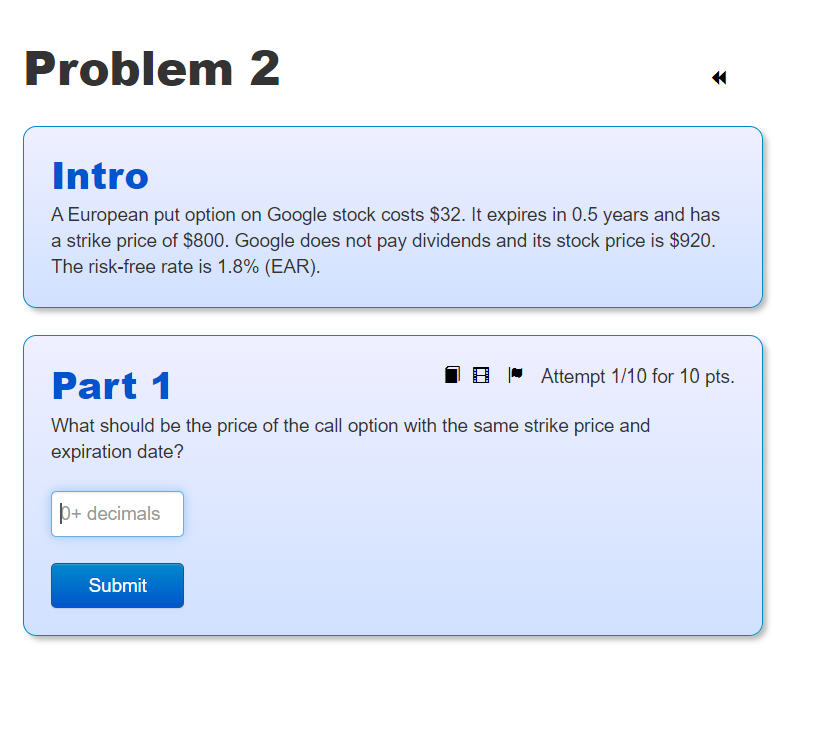

Problem 1 18 Attempt 1/5 for 10 pts. Part 1 A European call and a European put option have the same underlying stock, strike price, maturity date and premium. What can you say about this situation? Check all that apply: The call is in the money. The put is in the money. The stock price is negative. This situation is not possible. Submit Problem 2 Intro A European put option on Google stock costs $32. It expires in 0.5 years and has a strike price of $800. Google does not pay dividends and its stock price is $920. The risk-free rate is 1.8% (EAR). Part 1 18 Attempt 1/10 for 10 pts. What should be the price of the call option with the same strike price and expiration date? + decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts