Question: help Required information Problem 4-32 (LO 4-1) (Algo) [The following information applies to the questions displayed below.] Eklya, who is single, has been offered a

![applies to the questions displayed below.] Eklya, who is single, has been](https://s3.amazonaws.com/si.experts.images/answers/2024/08/66d1f27701b50_12666d1f2767c88a.jpg)

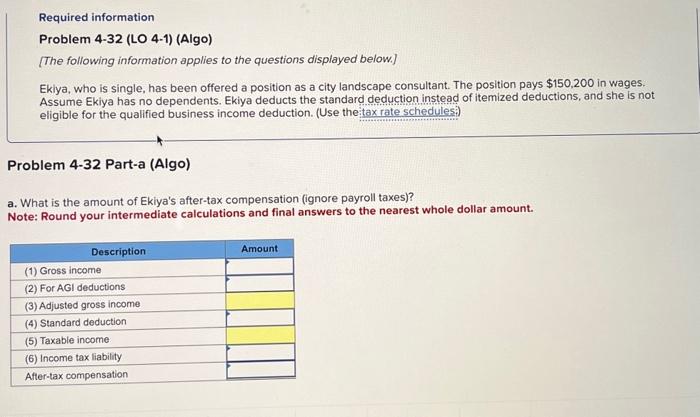

Required information Problem 4-32 (LO 4-1) (Algo) [The following information applies to the questions displayed below.] Eklya, who is single, has been offered a position as a city landscape consultant. The position pays $150,200 in wages. Assume Ekiya has no dependents. Ekiya deducts the standard deduction instead of itemized deductions, and she is not eligible for the qualified business income deduction. (Use the:tax rate schedules;) Problem 4-32 Part-a (Algo) a. What is the amount of Ekiya's after-tax compensation (ignore payroll taxes)? Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. 2023 Tax Rate Schedules Individuals Schedule X-Single \begin{tabular}{|c|c|c|} The tax is: \\ \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The } \\ \hline$0 & $11,000 & 10% of taxable income \\ \hline$11,000 & $44,725 & $1,100 plus 12% of the excess over $11,000 \\ \hline$44,725 & $95,375 & $5,147 plus 22% of the excess over $44,725 \\ \hline$95,375 & $182,100 & $16,290 plus 24% of the excess over $95,375 \\ \hline$182,100 & $231,250 & $37,104 plus 32% of the excess over $182,100 \\ \hline$231,250 & $578,125 & $52,832 plus 35% of the excess over $231,250 \\ \hline$578,125 & - & $174,238.25 plus 37% of the excess over $578,125 \\ \hline \end{tabular} Schedule Y-1-Married Filing Jointly or Qualifying surviving spouse The tax is: \begin{tabular}{|c|c|c|} If taxable income is over: But not over: & The \\ \hline$0 & $22,000 & 10% of taxable income \\ \hline$22,000 & $89,450 & $2,200 plus 12% of the excess over $22,000 \\ \hline$89,450 & $190,750 & $10,294 plus 22% of the excess over $89,450 \\ \hline$190,750 & $364,200 & $32,580 plus 24% of the excess over $190,750 \\ \hline$364,200 & $462,500 & $74,208 plus 32% of the excess over $364,200 \\ \hline$462,500 & $693,750 & $105,664 plus 35% of the excess over $462,500 \\ \hline$693,750 & - & $186,6015 plus 37% of the excess over $693,750 \\ \hline \end{tabular} Schedule Z-Head of Household Schedule Z-Head of Household \begin{tabular}{|c|c|c|} If taxable income is over: & But not over: & The tax is: \\ \hline$0 & $15,700 & 10% of taxable income \\ \hline$15,700 & $59,850 & $1,570 plus 12% of the excess over $15,700 \\ \hline$59,850 & $95,350 & $6,868 plus 22% of the excess over $59,850 \\ \hline$95,350 & $182,100 & $14,678 plus 24% of the excess over $95,350 \\ \hline$182,100 & $231,250 & $35,498 plus 32% of the excess over $182,100 \\ \hline$231,250 & $578,100 & $51,226 plus 35% of the excess over $231,250 \\ \hline$578,100 & - & $172,623.5 plus 37% of the excess over $578,100 \\ \hline \end{tabular} Schedule Y-2-Married Filing Separately Schedule Y-2-Married Filing Separately \begin{tabular}{|c|c|c|} If taxable income is over: & Tut not over: & \multicolumn{1}{|c|}{ The is: } \\ \hline$0 & $11,000 & 10% of taxable income \\ \hline$11,000 & $44,725 & $1,100 plus 12% of the excess over $11,000 \\ \hline$44,725 & $95,375 & $5,147 plus 22% of the excess over $44,725 \\ \hline$95,375 & $182,100 & $16,290 plus 24% of the excess over $95,375 \\ \hline$182,100 & $231,250 & $37,104 plus 32% of the excess over $182,100 \\ \hline$231,250 & $346,875 & $52,832 plus 35% of the excess over $231,250 \\ \hline$346,875 & - & $93,300,75 plus 37% of the excess over $346,875 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts