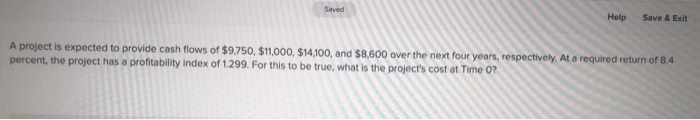

Question: Help Save & Exit A project is expected to provide cash flows of $9,750, $11,000, $14,100, and $8,600 over the next four years, respectively. At

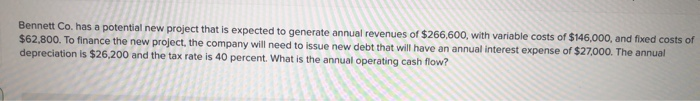

Help Save & Exit A project is expected to provide cash flows of $9,750, $11,000, $14,100, and $8,600 over the next four years, respectively. At a required return of 8.4 percent, the project has a profitability Index of 1.299. For this to be true, what is the project's cost at Time 0? Bennett Co. has a potential new project that is expected to generate annual revenues of $266,600, with variable costs of $146,000, and fixed costs of $62,800. To finance the new project, the company will need to issue new debt that will have an annual interest expense of $27,000. The annual depreciation is $26,200 and the tax rate is 40 percent. What is the annual operating cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts