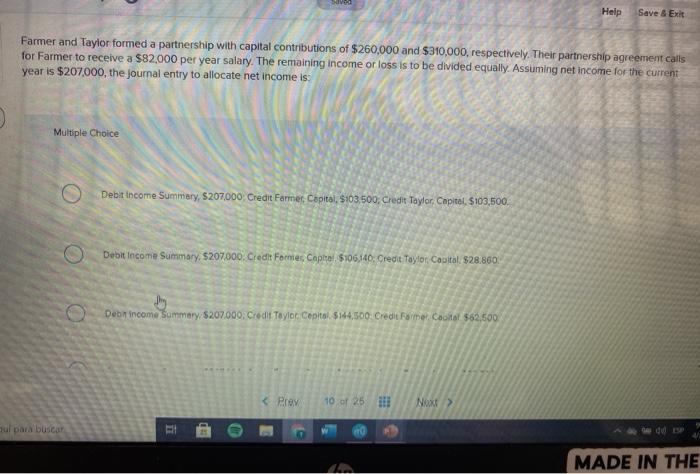

Question: Help Save & Exit Farmer and Taylor formed a partnership with capital contributions of $260,000 and $310,000, respectively. Their partnership agreement calls for Farmer to

Help Save & Exit Farmer and Taylor formed a partnership with capital contributions of $260,000 and $310,000, respectively. Their partnership agreement calls for Farmer to receive a $82,000 per year salary. The remaining income or loss is to be divided equally. Assuming net income for the current year is $207,000, the journal entry to allocate net income is Multiple Choice Debit Income Summary, 5207,000 Credit Farmer, Capital, $103 500, Credit Taylor, Capital, $103,500 Debit Income Summary, $207.000. Credit Forte Capital $106140: Credit Taylor, Capital $28.860 Debin income Summary $207.000: Credit Taylor Cepital $144,500: Credit Romer. Catal562,500 P ul para buscar MADE IN THE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts