Question: Help Save & Exit Submit A stock has an expected return of 14.1 percent, the risk-free rate is 3.6 percent, and the market risk premium

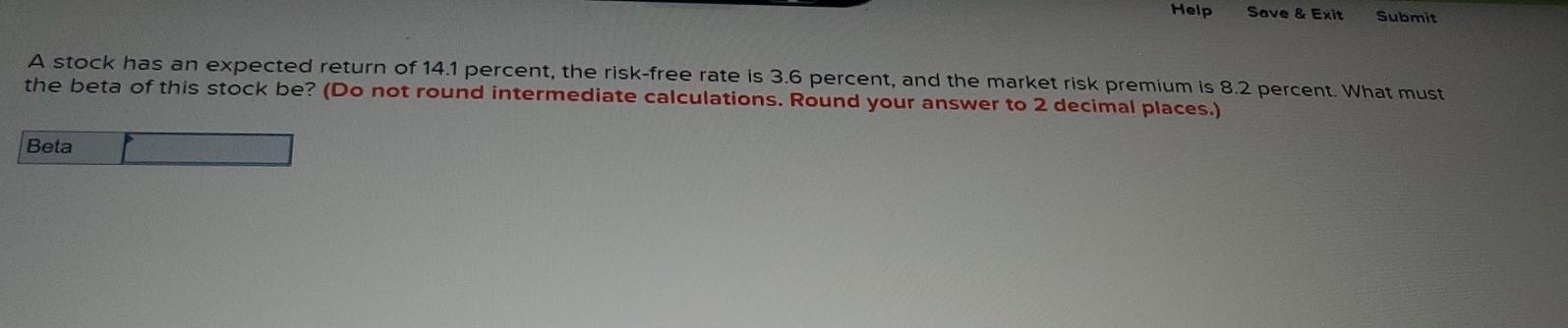

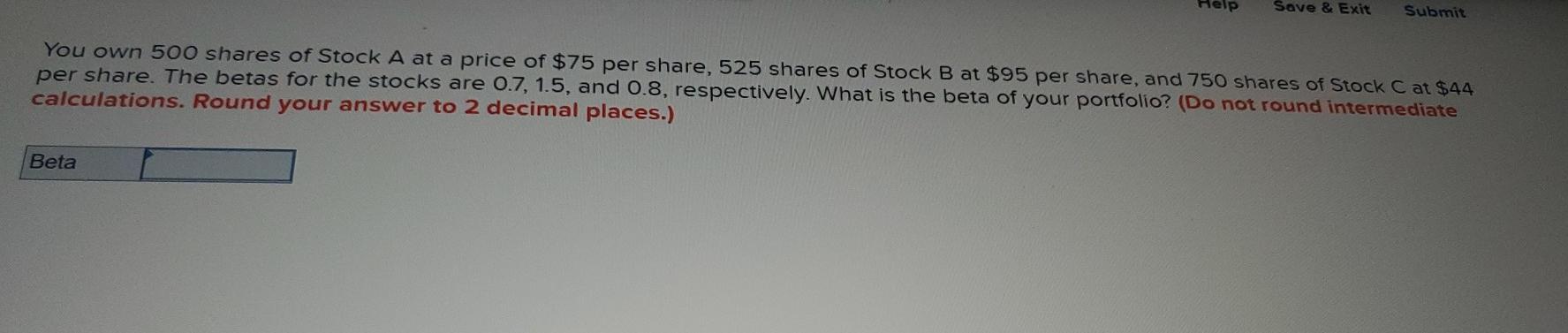

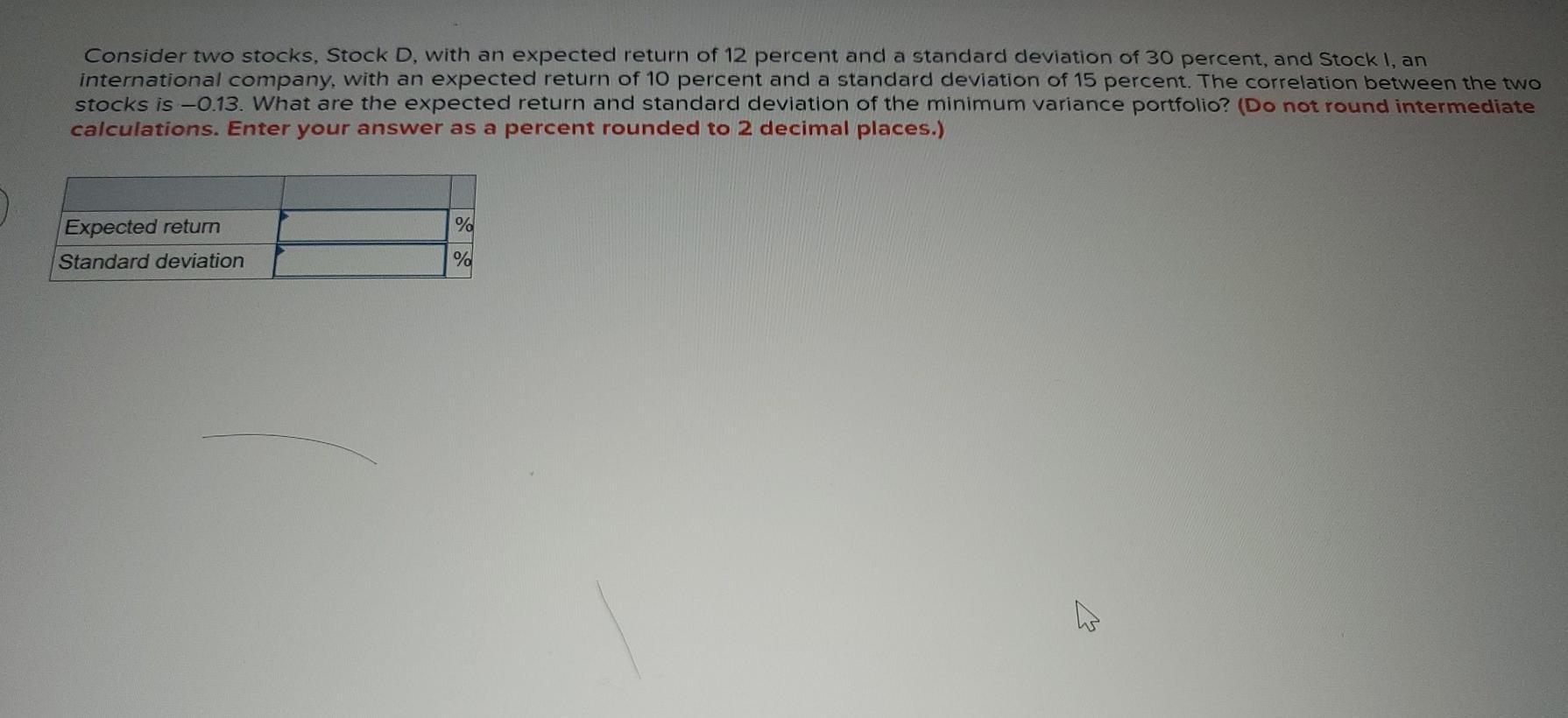

Help Save & Exit Submit A stock has an expected return of 14.1 percent, the risk-free rate is 3.6 percent, and the market risk premium is 8.2 percent. What must the beta of this stock be? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Beta Save & Exit Submit You own 500 shares of Stock A at a price of $75 per share, 525 shares of Stock B at $95 per share, and 750 shares of Stock Cat $44 per share. The betas for the stocks are 0.7, 1.5, and 0.8, respectively. What is the beta of your portfolio? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Beta Consider two stocks, Stock D, with an expected return of 12 percent and a standard deviation of 30 percent, and Stock I, an international company, with an expected return of 10 percent and a standard deviation of 15 percent. The correlation between the two stocks is-0.13. What are the expected return and standard deviation of the minimum variance portfolio? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) % Expected return Standard deviation %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts