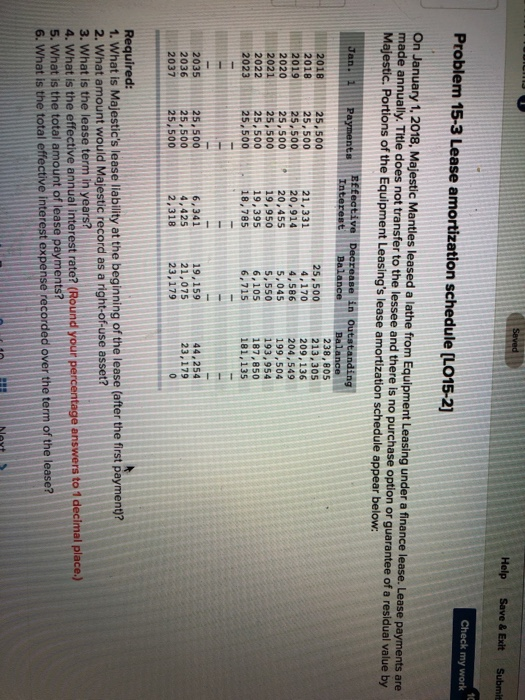

Question: Help Save & Exit Submit Check my work Problem 15-3 Lease amortization schedule [LO15-2] On January 1. 2018, Majestic Mantles leased a lathe from Equipment

Help Save & Exit Submit Check my work Problem 15-3 Lease amortization schedule [LO15-2] On January 1. 2018, Majestic Mantles leased a lathe from Equipment Leasing under a finance lease. Lease payments are made annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a residual value by Majestic. Portions of the Equipment Leasing's lease amortization schedule appear below 25,500 25,500 25,500 25,500 25,500 25,500 25.500 238,805 213,305 209,136 204,549 199,504 193,954 187,850 2018 2018 2020 2021 2022 2023 21,331 20,914 20,455 19,950 19,395 18,785 25,500 4,170 4,586 5,045 5,550 6,705101.135 2035 25,500 2036 203725,500 6,341 4,425 2,318 19,159 21,075 25,500 23,179 Required: 1. What is Majestic's lease liability at the beginning of the lease (after the first payment)? 2. What amount would Majestic record as a right-of-use asset? 3. What is the lease term in years? hat is the effective annual interest rate? (Round your percentage answers to 1 decimal place.) 5. What is the total amount of lease payments? 6. What is the total effective interest expense recorded over the term of the lease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts