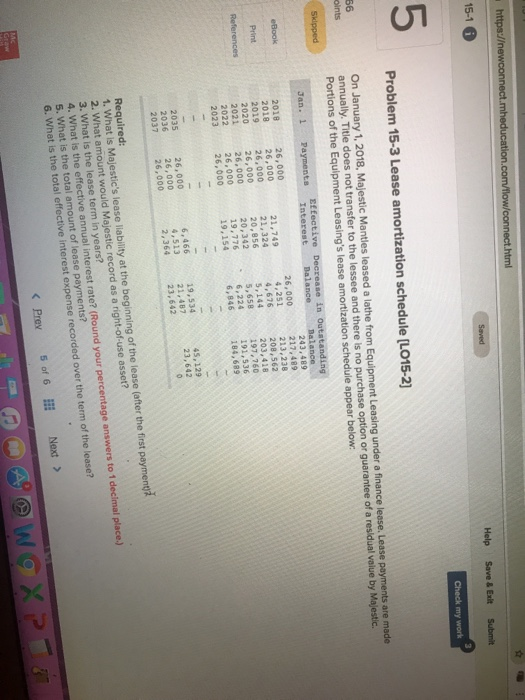

Question: Solve the required please. Thank you so much. 5 Problem 15-3 Lease amortization schedule [LO15-2] On January 1, 2018, Majestic Mantles leased a lathe from

![Lease amortization schedule [LO15-2] On January 1, 2018, Majestic Mantles leased a](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e8c9395e351_89666e8c938a2145.jpg)

5 Problem 15-3 Lease amortization schedule [LO15-2] On January 1, 2018, Majestic Mantles leased a lathe from Equipment Leasing under a finance lesse. Lease payments are made annually. Title does not transfer to the lessee and there is no purchase option or guarantee of a Portions of the Equipment Leasing's lease amortization schedule appear below residual value by Majestic. nts Interes 243,489 2018 26,000 2018 2019 26,000 2020 2021 2022 2023 26,000 26,000 4,251 4,676 5,144 26,000 26,000 26,000 26,000 21,324 20,856 20,342 213,238 208,562 203,418 760 45,129 6,466 4,513 2,364 19,534 2035 2036 2037 26,000 26,000 26,000 1. Wnat is Majestic's lease liability at the beginning of the lease (efter the irst ayment 3. What is the lease term in years? 4. What is the effective annual interest rate? (Round your percentage answers to 1 5. What is the total amount of lease payments? 6. What is the total effective inte decimal place.) rest expense recorded over the term of the lease?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts