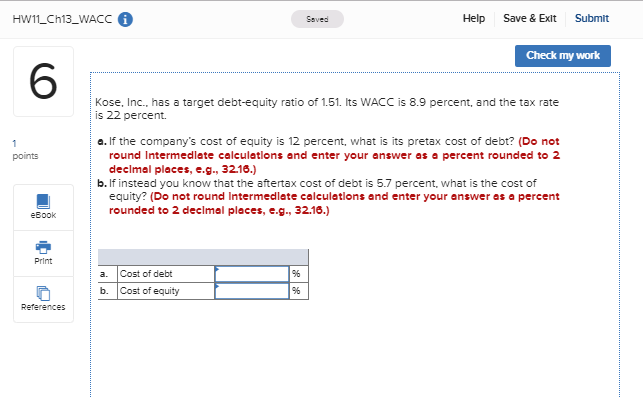

Question: Help Save & Exit Submit HW1_Ch13_WACC Saved Check my work 6 Kose, Inc.. has a target debt-equity ratio of 1.51. Its WACC is 8.9 percent,

Help Save & Exit Submit HW1_Ch13_WACC Saved Check my work 6 Kose, Inc.. has a target debt-equity ratio of 1.51. Its WACC is 8.9 percent, and the tax rate is 22 percent. a. If the company's cost of equity is 12 percent, what is its pretax cost of debt? (Do not round Intermedlate calculations and enter your answer as a percent rounded to 2 declmal places, e.g., 3216.) b. If instead you know that the aftertax cost of debt is 5.7 percent, what is the cost of equity? (Do not round Intermedlate calculetions and enter your answer es a percent rounded to 2 declmal places, e.g., 32.16.) 1 points eBook Print 96 Cost of debt a. Cost of equity 9% b. References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts