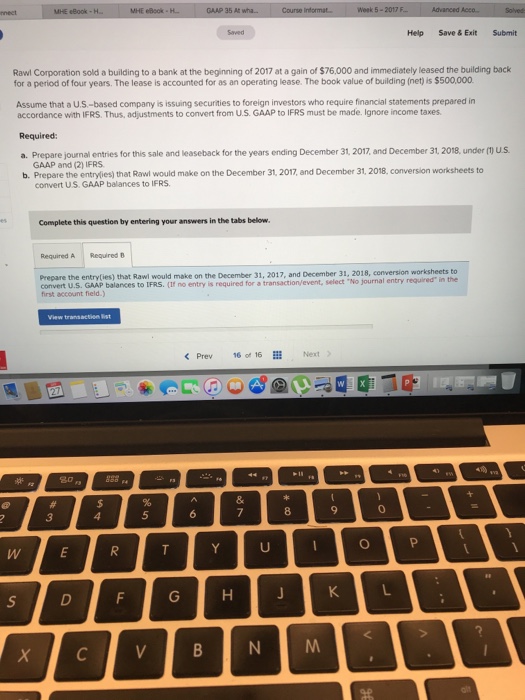

Question: Help Save& Exit Submit Rawl Corporation sold a building to a bank at the beginning of 2017 at a gain of $76,000 and immediately leased

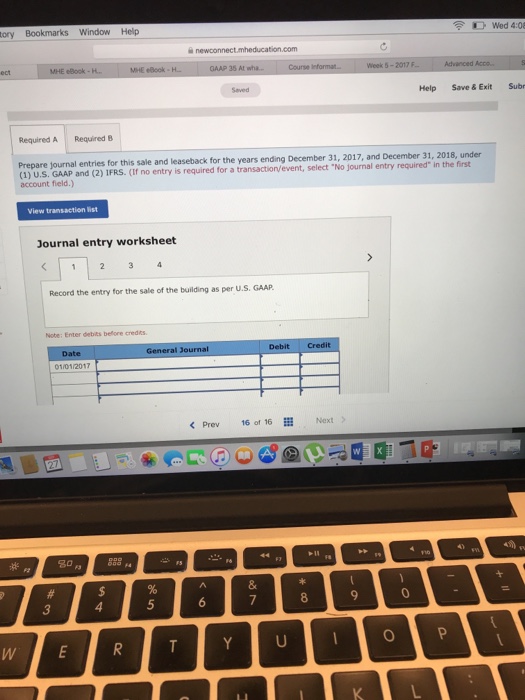

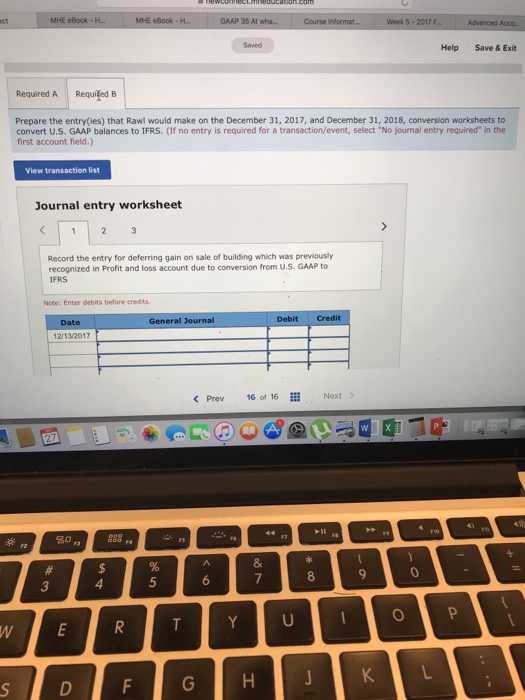

Help Save& Exit Submit Rawl Corporation sold a building to a bank at the beginning of 2017 at a gain of $76,000 and immediately leased the building back for a period of four years. The lease is accounted for as an operating lease. The book value of building (net) is $500,000 Assume that a U.S-based company is issuing securities to foreign investors who require financial statements prepared in accordance with IFRS. Thus, adjustments to convert from U.S. GAAP to IFRS must be made. Ignore income taxers Required: a. Prepare journal entries for this sale and leaseback for the years ending December 31, 2017, and December 31, 2018, under () U.S GAAP and (2) IFRS b. Prepare the entrylies) that Rawl would make on the December 31, 2017, and December 31, 2018, conversion worksheets to convert U.S. GAAP balances to IFRS. Complete this question by entering your answers in the tabs below. Required A Required B Prepare the entry(ies) that Rawl would make on the December 31, 2017, and December 31, 2018, conversion worksheets to convert U.S. GAAP balances to IFRS. (Ir no entry is required for a transaction/event, select "No journal entry first account field.) 20 3 5 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts