Question: ***PLEASE HELP WITH REQUIRED B, PART #2 CALCULATION*** Rawl Corporation sold a building to a bank at the beginning of 2017 at a gain of

***PLEASE HELP WITH REQUIRED B, PART #2 CALCULATION***

Rawl Corporation sold a building to a bank at the beginning of 2017 at a gain of $90,000 and immediately leased the building back for a period of four years. The lease is accounted for as an operating lease. The book value of building (net) is $519,000.

Assume that a U.S.based company is issuing securities to foreign investors who require financial statements prepared in accordance with IFRS. Thus, adjustments to convert from U.S. GAAP to IFRS must be made. Ignore income taxes.

Required:

A. Prepare journal entries for this sale and leaseback for the years ending December 31, 2017, and December 31, 2018, under (1) U.S. GAAP and (2) IFRS.

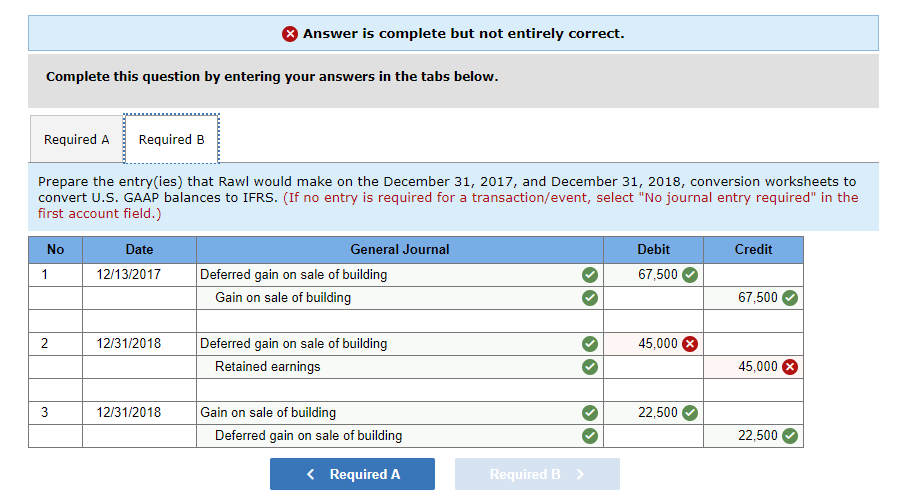

B. Prepare the entry(ies) that Rawl would make on the December 31, 2017, and December 31, 2018, conversion worksheets to convert U.S. GAAP balances to IFRS.

Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Prepare the entry(ies) that Rawl would make on the December 31, 2017, and December 31, 2018, conversion worksheets to convert U.S. GAAP balances to IFRS. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Date Credit Debit 67,500 1 General Journal Deferred gain on sale of building Gain on sale of building 12/13/2017 67,500 2 12/31/2018 45,000 Deferred gain on sale of building Retained earnings 45,000 12/31/2018 22,500 Gain on sale of building Deferred gain on sale of building 22,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts