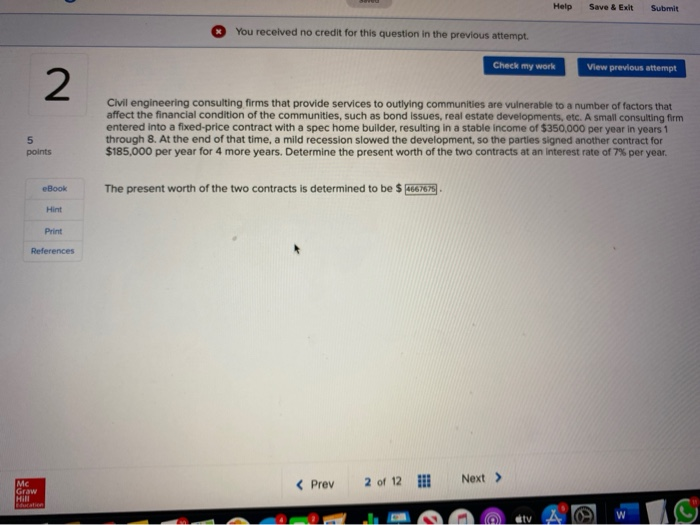

Question: Help Save & Exit Submit You received no credit for this question in the previous attempt. Check my work View previous attempt Civil engineering consulting

Help Save & Exit Submit You received no credit for this question in the previous attempt. Check my work View previous attempt Civil engineering consulting firms that provide services to outlying communities are vulnerable to a number of factors that affect the financial condition of the communities, such as bond issues, real estate developments, etc. A small consulting firm entered into a fixed price contract with a spec home builder, resulting in a stable income of $350,000 per year in years 1 through 8. At the end of that time, a mild recession slowed the development, so the parties signed another contract for $185.000 per year for 4 more years. Determine the present worth of the two contracts at an interest rate of 7% per year points eBook The present worth of the two contracts is determined to be $467673 Hint Print References 400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts