Question: Help Save & Exit USE THE FOLLOWING INFORMATION FOR QUESTIONS 9-12 Hawkeye Innovations is considering developing a new type of mous trap. They have made

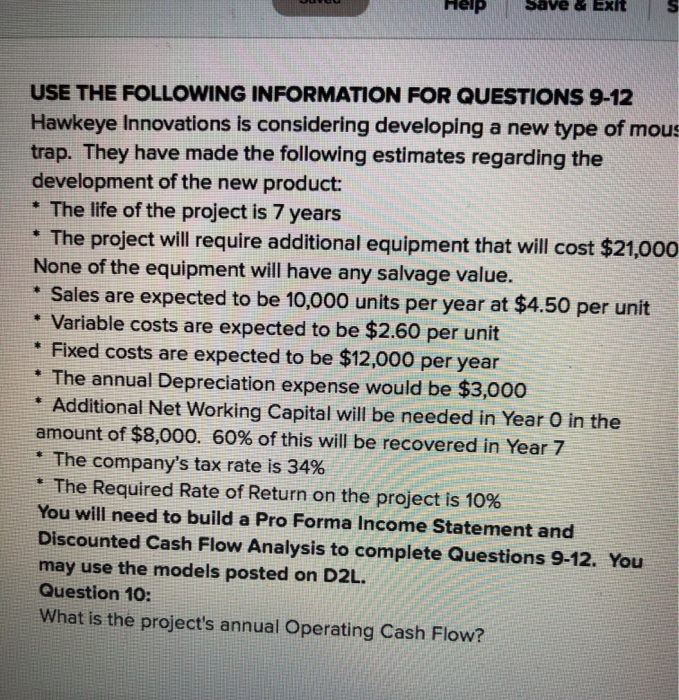

Help Save & Exit USE THE FOLLOWING INFORMATION FOR QUESTIONS 9-12 Hawkeye Innovations is considering developing a new type of mous trap. They have made the following estimates regarding the development of the new product: The life of the project is 7 years * The project will require additional equipment that will cost $21,000 None of the equipment will have any salvage value. * Sales are expected to be 10,000 units per year at $4.50 per unit * Variable costs are expected to be $2.60 per unit * Fixed costs are expected to be $12,000 per year The annual Depreciation expense would be $3,000 * Additional Net Working Capital will be needed in Year O in the amount of $8,000. 60% of this will be recovered in Year 7 The company's tax rate is 34% * The Required Rate of Return on the project is 10% You will need to build a Pro Forma Income Statement and Discounted Cash Flow Analysis to complete Questions 9-12. You may use the models posted on D2L. Question 10: What is the project's annual Operating Cash Flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts