Question: It's all connected question. I need help. USE THE FOLLOWING INFORMATION FOR QUESTIONS 9-12 Hawkeye Innovations is considering developing a new type of mouse trap.

It's all connected question. I need help.

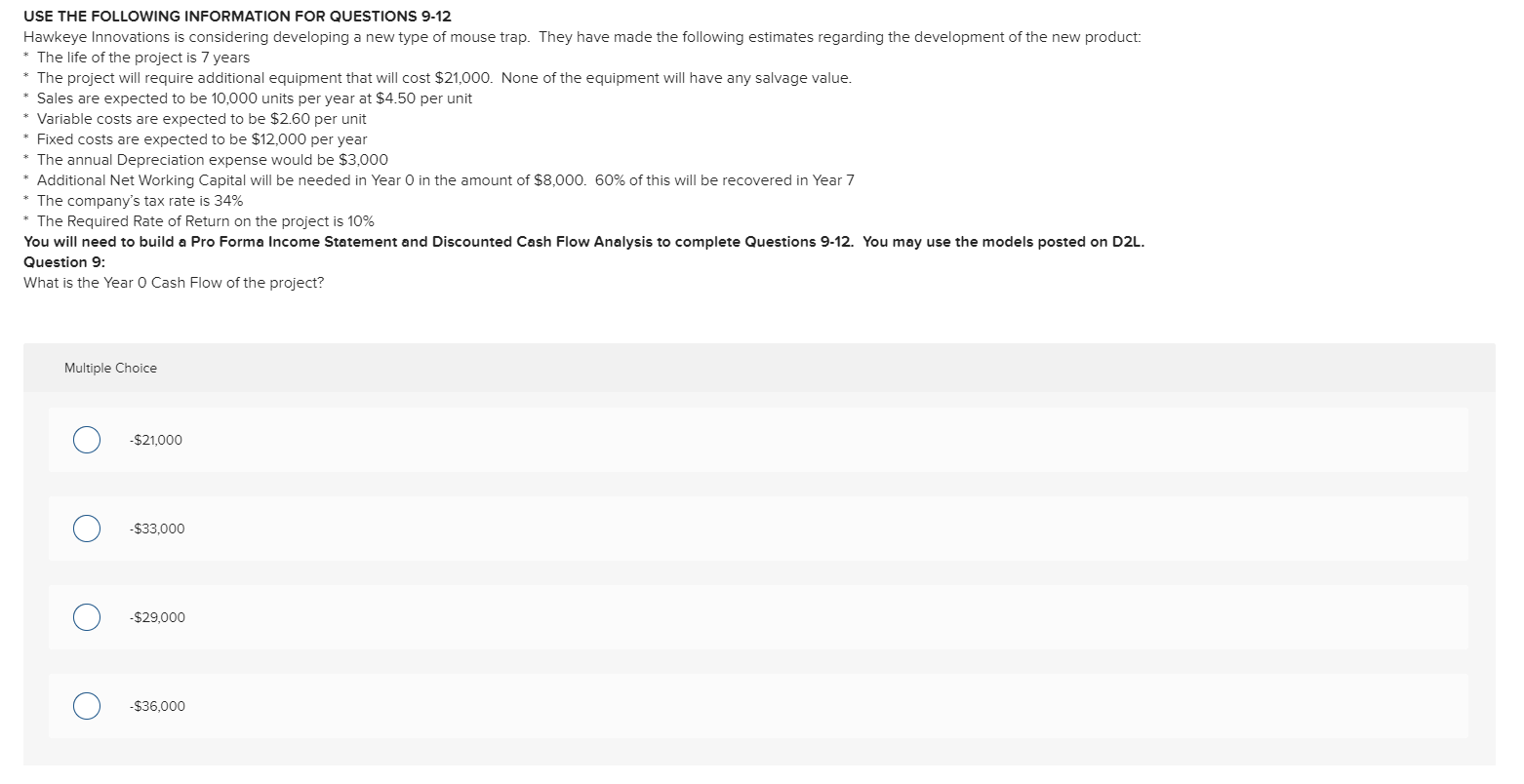

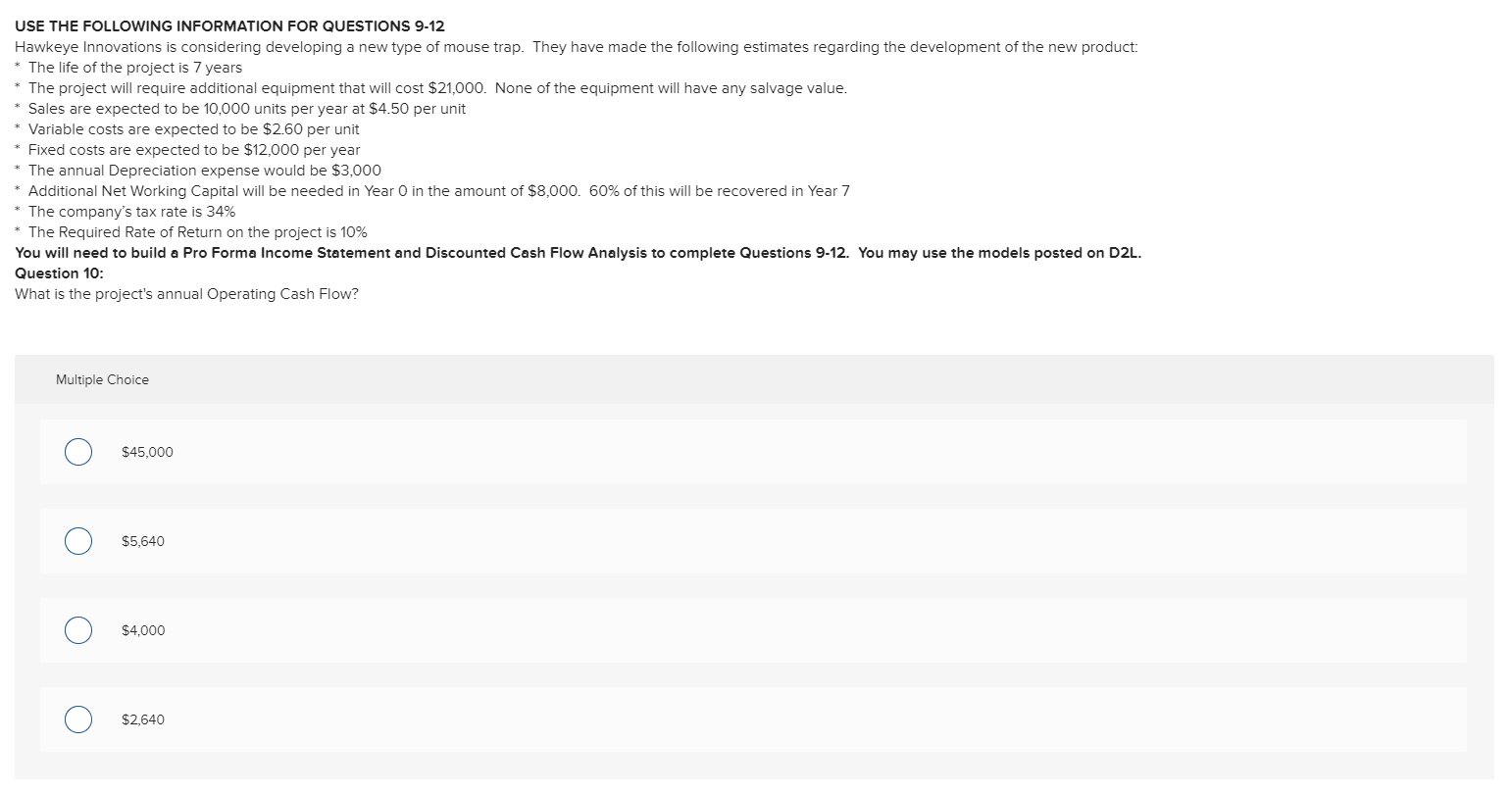

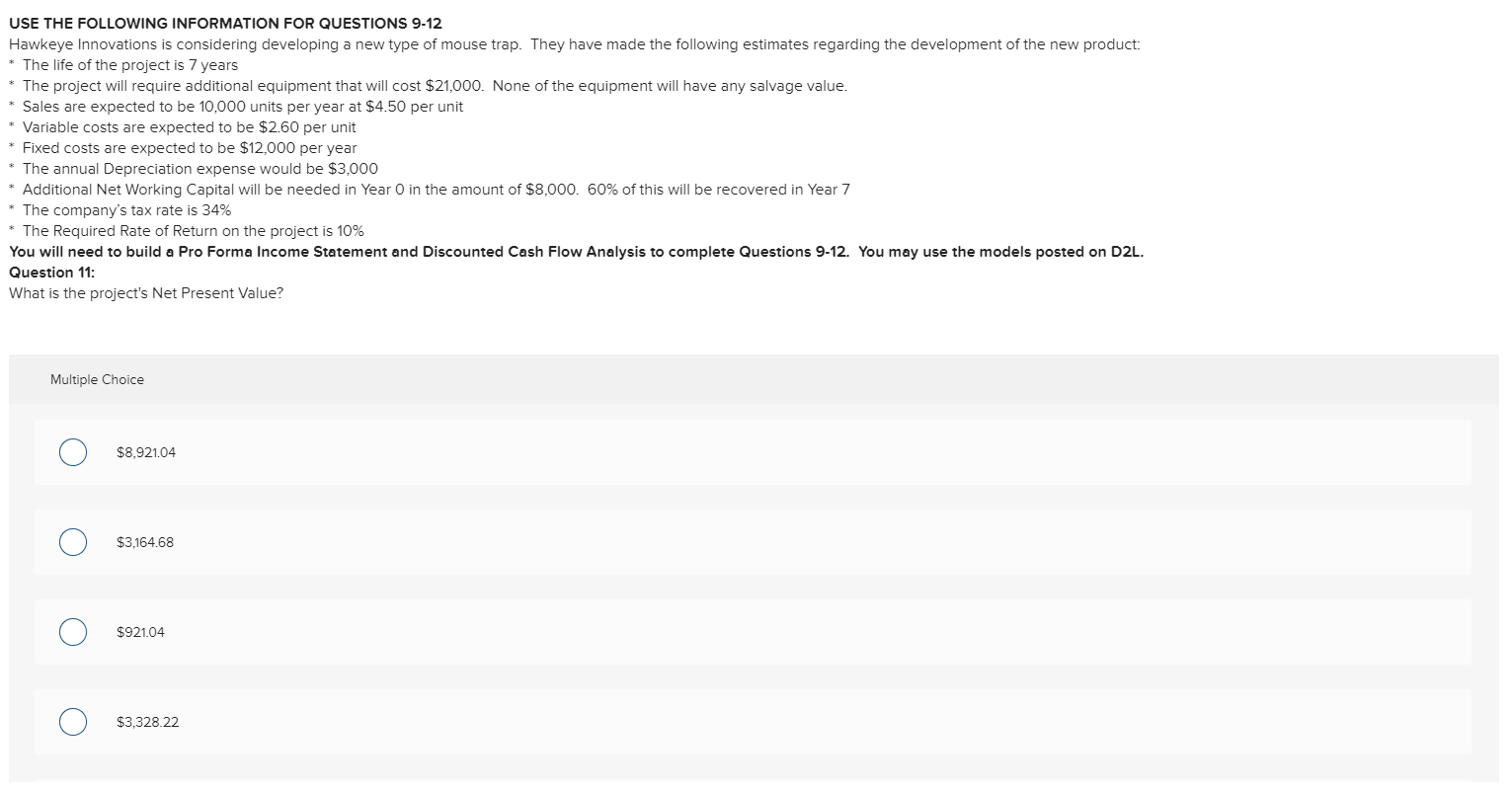

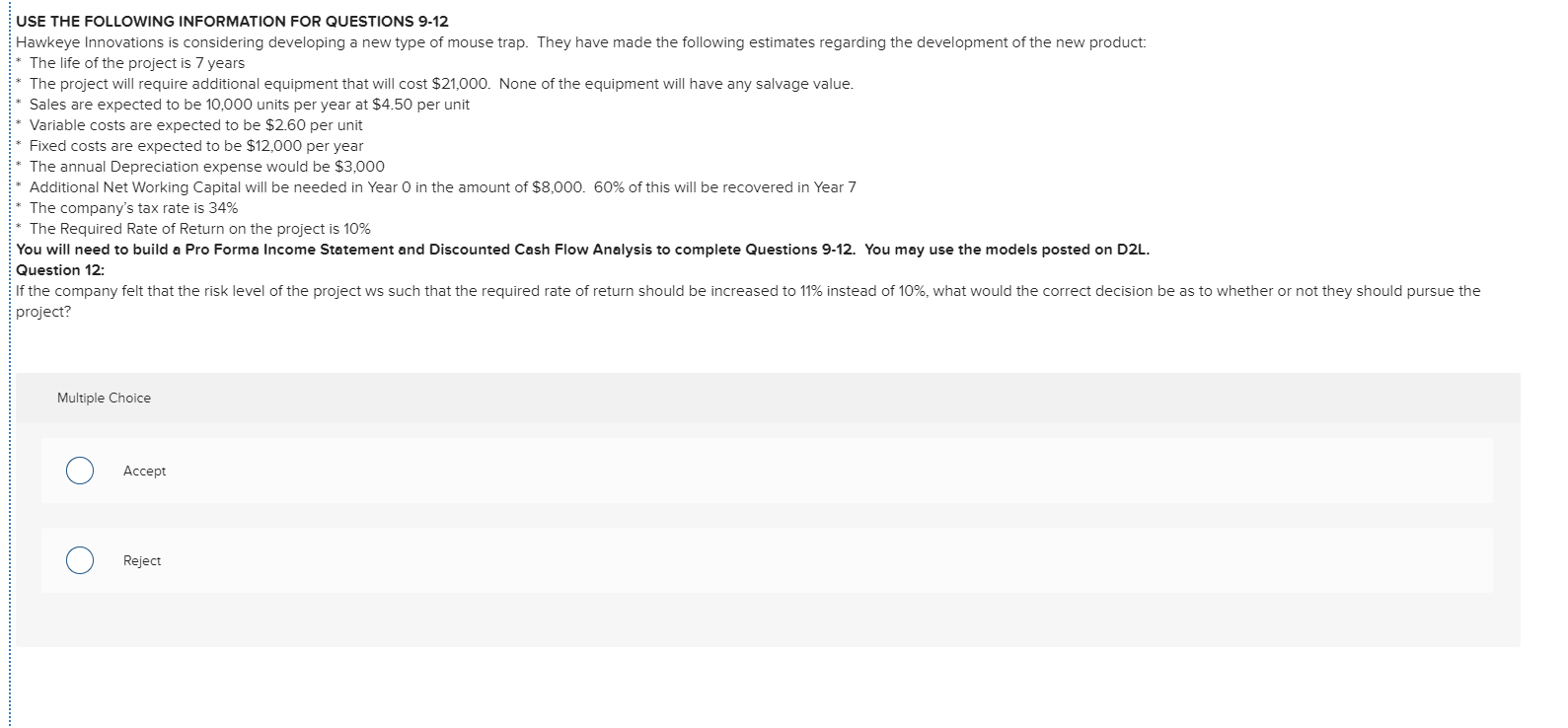

USE THE FOLLOWING INFORMATION FOR QUESTIONS 9-12 Hawkeye Innovations is considering developing a new type of mouse trap. They have made the following estimates regarding the development of the new product: * The life of the project is 7 years * The project will require additional equipment that will cost $21,000. None of the equipment will have any salvage value. * Sales are expected to be 10,000 units per year at $4.50 per unit * Variable costs are expected to be $2.60 per unit * Fixed costs are expected to be $12,000 per year * The annual Depreciation expense would be $3,000 * Additional Net Working Capital will be needed in Year O in the amount of $8,000. 60% of this will be recovered in Year 7 * The company's tax rate is 34% * The Required Rate of Return on the project is 10% You will need to build a Pro Forma Income Statement and Discounted Cash Flow Analysis to complete Questions 9-12. You may use the models posted on D2L. Question 9: What is the Year O Cash Flow of the project? Multiple Choice $21,000 $33,000 Loooo -$29,000 $36,000 USE THE FOLLOWING INFORMATION FOR QUESTIONS 9-12 Hawkeye Innovations is considering developing a new type of mouse trap. They have made the following estimates regarding the development of the new product: * The life of the project is 7 years * The project will require additional equipment that will cost $21,000. None of the equipment will have any salvage value. * Sales are expected to be 10,000 units per year at $4.50 per unit * Variable costs are expected to be $2.60 per unit * Fixed costs are expected to be $12,000 per year * The annual Depreciation expense would be $3,000 * Additional Net Working Capital will be needed in Year O in the amount of $8,000. 60% of this will be recovered in Year 7 * The company's tax rate is 34% * The Required Rate of Return on the project is 10% You will need to build a Pro Forma Income Statement and Discounted Cash Flow Analysis to complete Questions 9-12. You may use the models posted on D2L. Question 10: What is the project's annual Operating Cash Flow? Multiple Choice $45,000 $5,640 o ooo $4,000 $2,640 USE THE FOLLOWING INFORMATION FOR QUESTIONS 9-12 Hawkeye Innovations is considering developing a new type of mouse trap. They have made the following estimates regarding the development of the new product: * The life of the project is 7 years * The project will require additional equipment that will cost $21,000. None of the equipment will have any salvage value. * Sales are expected to be 10,000 units per year at $4.50 per unit * Variable costs are expected to be $2.60 per unit * Fixed costs are expected to be $12,000 per year * The annual Depreciation expense would be $3,000 * Additional Net Working Capital will be needed in Year O in the amount of $8,000. 60% of this will be recovered in Year 7 * The company's tax rate is 34% * The Required Rate of Return on the project is 10% You will need to build a Pro Forma Income Statement and Discounted Cash Flow Analysis to complete Questions 9-12. You may use the models posted on D2L. Question 11: What is the project's Net Present Value? Multiple Choice $8,921.04 $3,164.68 Loooo $921.04 $3,328.22 USE THE FOLLOWING INFORMATION FOR QUESTIONS 9-12 Hawkeye Innovations is considering developing a new type of mouse trap. They have made the following estimates regarding the development of the new product: * The life of the project is 7 years * The project will require additional equipment that will cost $21,000. None of the equipment will have any salvage value. * Sales are expected to be 10,000 units per year at $4.50 per unit * Variable costs are expected to be $2.60 per unit Fixed costs are expected to be $12,000 per year The annual Depreciation expense would be $3,000 * Additional Net Working Capital will be needed in Year O in the amount of $8,000. 60% of this will be recovered in Year 7 * The company's tax rate is 34% * The Required Rate of Return on the project is 10% You will need to build a Pro Forma Income Statement and Discounted Cash Flow Analysis to complete Questions 9-12. You may use the models posted on D2L. Question 12: If the company felt that the risk level of the project ws such that the required rate of return should be increased to 11% instead of 10%, what would the correct decision be as to whether or not they should pursue the project? Multiple Choice O Accept Accept Reject

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts