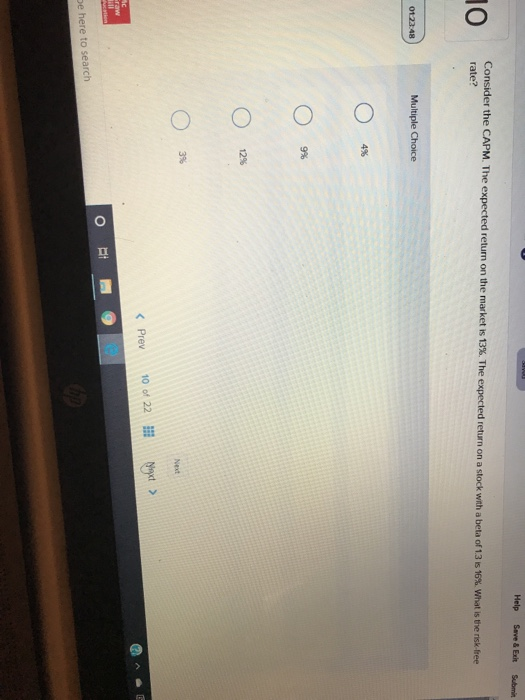

Question: Help Save & Ext Submit Consider the CAPM. The expected return on the market is 13%. The expected return on a stock with a beta

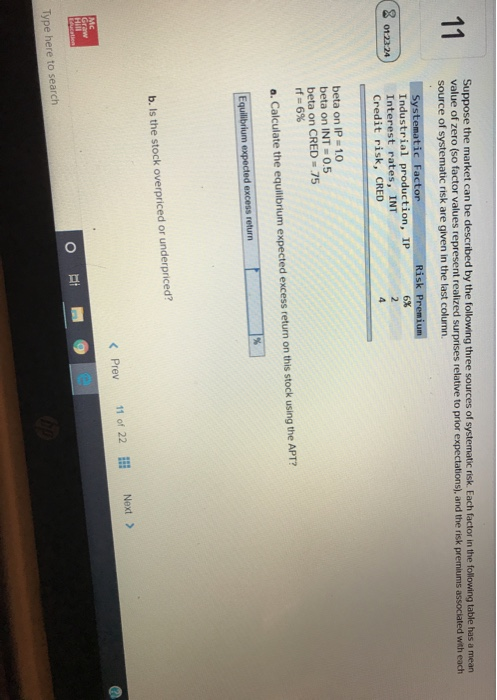

Help Save & Ext Submit Consider the CAPM. The expected return on the market is 13%. The expected return on a stock with a beta of 13 i 16%. What is the risk free rate? 0122:48 Multiple Choice o 4% o oo Next QA- o 9 De here to search 11 Suppose the market can be described by the following three sources of systematic risk. Each factor in the following table has a mean value of zero (so factor values represent realized surprises relative to prior expectations), and the risk premiums associated with each source of systematic risk are given in the last column Risk Premium 6% 8 01:22:24 Systematic Factor Industrial production, IP Interest rates, INT Credit risk, CRED beta on IP = 10 beta on INT=0.5 beta on CRED = 75 rf = 6% a. Calculate the equilibrium expected excess return on this stock using the APT? Equilibrium expected excess return b. Is the stock overpriced or underpriced? 11 of 22 !!! Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts