Question: Help Save Hunter, Folgers, and Tulip have been partners while sharing net income and loss in a 5:3:2 ratio (in percents: Hunter, 50%; Folgers, 30%;

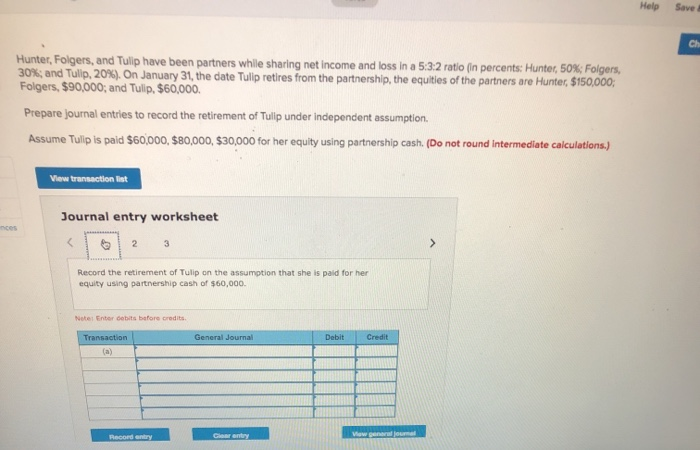

Help Save Hunter, Folgers, and Tulip have been partners while sharing net income and loss in a 5:3:2 ratio (in percents: Hunter, 50%; Folgers, 30%; and Tulip, 20%). On January 31, the date Tulip retires from the partnership, the equities of the partners are Hunter, $150,000; Folgers, $90,000; and Tulip $60,000 Prepare journal entries to record the retirement of Tulip under independent assumption. Assume Tulip is paid $60,000, $80,000, $30,000 for her equity using partnership cash. (Do not round intermediate calculations.) View transaction int Journal entry worksheet 2 3 > Record the retirement of Tulip on the assumption that she is paid for her equity using partnership cash of $60,000 Note Entor Gebits before credits General Journal Debit Credit Transaction (a) Record Cheat entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts