Question: Help Save & Mt. and Mrs. Anderson file a joint return. They provide more than 50% of the financial support for their two children, Dana,

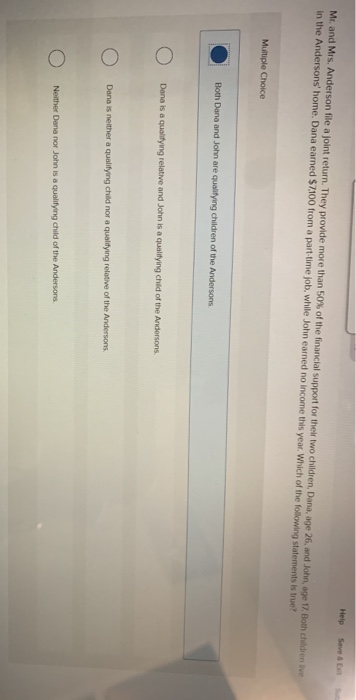

Help Save & Mt. and Mrs. Anderson file a joint return. They provide more than 50% of the financial support for their two children, Dana, age 26, and John, age 17. Both children live in the Andersons' home. Dana earned $7100 from a part-time job, while John earned no income this year. Which of the following statements is true? Multiple Choice Both Dana and John are qualifying children of the Andersons Dana is a qualifying relative and John is a qualifying child of the Andersons. Dana is neither a qualifying child nor a qualifying relative of the Andersons Neither Dana nor John is a qualifying child of the Andersons

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts