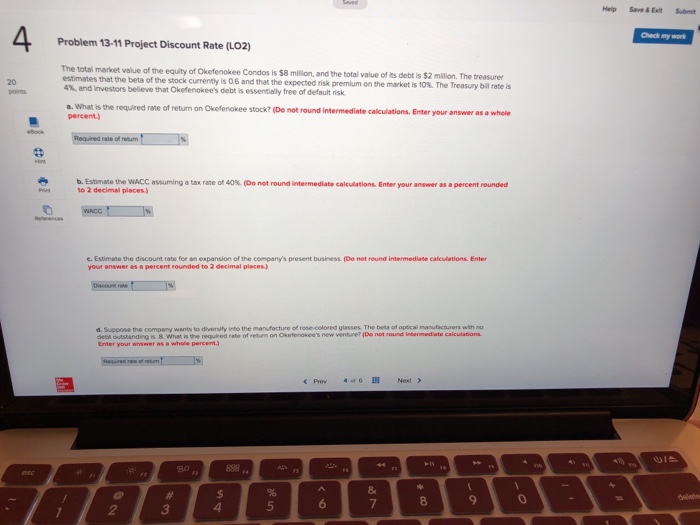

Question: Help Save&Exlt Sumt Check my work Problem 13-11 Project Discount Rate (LO2) The total market value of the equity of Okefenokee Condos is $8 million,

Help Save&Exlt Sumt Check my work Problem 13-11 Project Discount Rate (LO2) The total market value of the equity of Okefenokee Condos is $8 million, and the total value of estimates that the beta of the stock currently is 06 and that the 4%, and investors believe that Okefenokee's debt is essentially free of default nsk its debt is $2 millon. The treasurer 20 expected risk premium on the market is 10%. The Treasury bil rate is a. What is the required rate of return on Okefenokee stock?Do not round intermediate calculations. Enter your answer as a whole b. Estimate the WACC assuming a tax rate of 40% (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places c. Estimate the discount rate for an expansion of the companys present business. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) d. Suppose the compeny wents to diversity into the manufacture of rose-colored glasses. The beta of optical manufacturers with no debt outstanding i Enter your answer as a whole percent) s 8 What is the requred rate of eetun on Okefenokee's new venture? (Do not round Intermediate caiculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts