Question: Problem 13-11 Project Discount Rate (LO2) The total market value of the equity of Okefenokee Condos is $4 million, and the total value of its

Problem 13-11 Project Discount Rate (LO2)

Problem 13-11 Project Discount Rate (LO2)

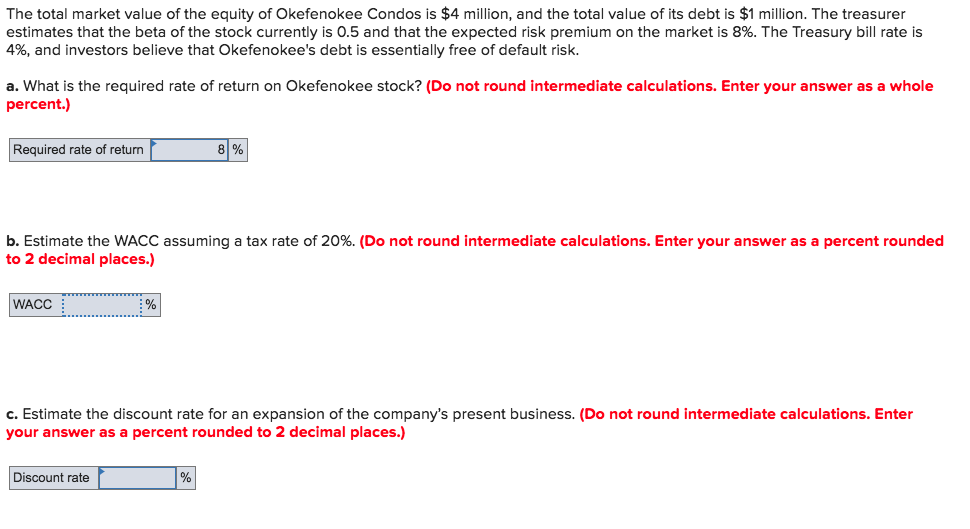

The total market value of the equity of Okefenokee Condos is $4 million, and the total value of its debt is $1 million. The treasurer estimates that the beta of the stock currently is 0.5 and that the expected risk premium on the market is 8%. The Treasury bill rate is 4%, and investors believe that Okefenokee's debt is essentially free of default risk. a. What is the required rate of return on Okefenokee stock? (Do not round intermediate calculations. Enter your answer as a whole percent.) Required rate of return 81 % ! b. Estimate the WACC assuming a tax rate of 20%. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) WACC c. Estimate the discount rate for an expansion of the company's present business. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts