Question: help solve please! how to solve with a calculator would be helpful 3. The following table shows the past annual returns for Stock A and

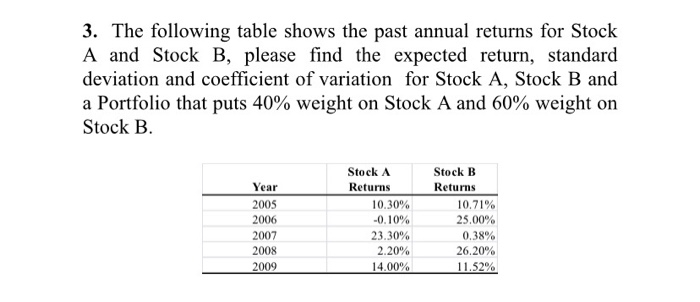

3. The following table shows the past annual returns for Stock A and Stock B, please find the expected return, standard deviation and coefficient of variation for Stock A, Stock B and a Portfolio that puts 40% weight on Stock A and 60% weight on Stock B. Year 2005 2006 2007 2008 2009 Stock A Returns 10.30% -0.10% 23.30% 2.20% 14.00% Stock B Returns 10.71% 25.00% 0.38% 26,20% 11.52%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts