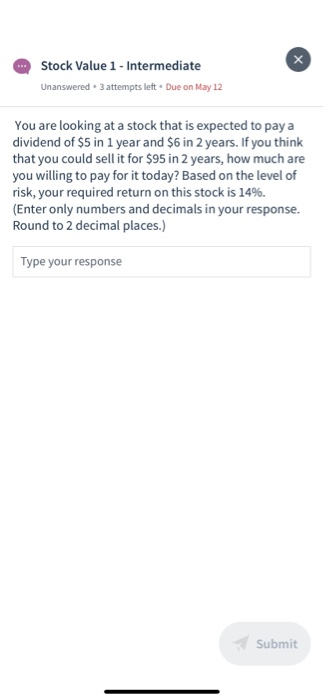

Question: Help solve please ... Stock Value 1 - Intermediate Unanswered 3 attempts left. Due on May 12 You are looking at a stock that is

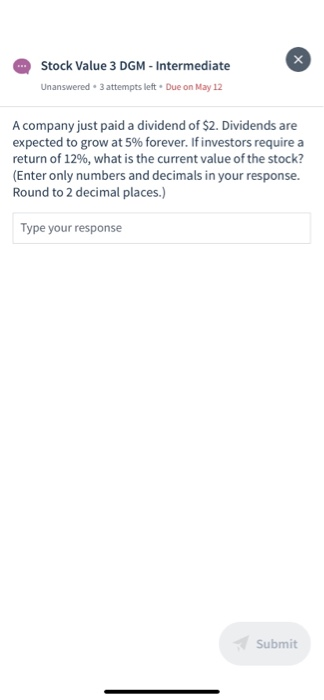

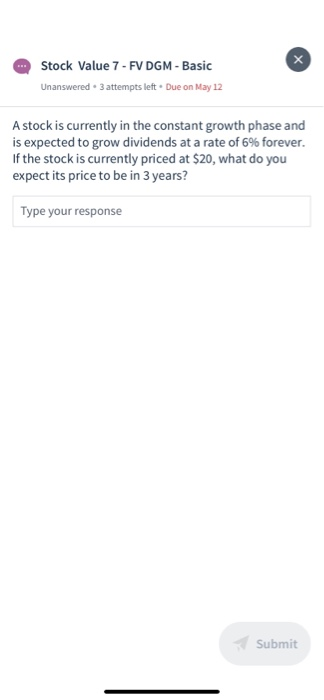

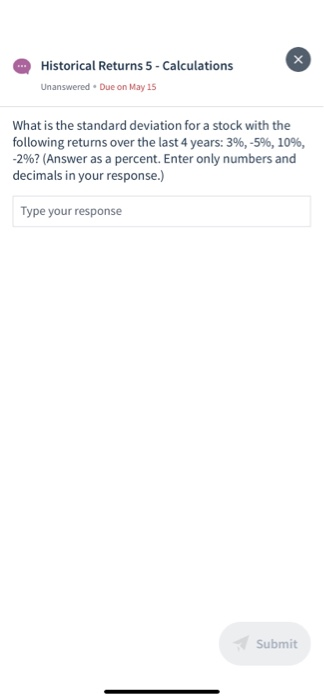

... Stock Value 1 - Intermediate Unanswered 3 attempts left. Due on May 12 You are looking at a stock that is expected to pay a dividend of $5 in 1 year and $6 in 2 years. If you think that you could sell it for $95 in 2 years, how much are you willing to pay for it today? Based on the level of risk, your required return on this stock is 14%. (Enter only numbers and decimals in your response. Round to 2 decimal places.) Type your response Submit Stock Value 3 DGM - Intermediate Unanswered 3 attempts left. Due on May 12 A company just paid a dividend of $2. Dividends are expected to grow at 5% forever. If investors require a return of 12%, what is the current value of the stock? (Enter only numbers and decimals in your response. Round to 2 decimal places.) Type your response Submit Stock Value 7 - FV DGM - Basic Unanswered 3 attempts left. Due on May 12 A stock is currently in the constant growth phase and is expected to grow dividends at a rate of 6% forever. If the stock is currently priced at $20, what do you expect its price to be in 3 years? Type your response Submit ... Historical Returns 5 - Calculations Unanswered. Due on May 15 What is the standard deviation for a stock with the following returns over the last 4 years: 3%, -5%, 10%, -2%? (Answer as a percent. Enter only numbers and decimals in your response.) Type your response Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts