Question: Help solve please Variable Costs, Contribution Margin, Contribution Margin Ratio Super-Tees Company plans to sell 11,000 T-shirts at $15 each in the coming year. Product

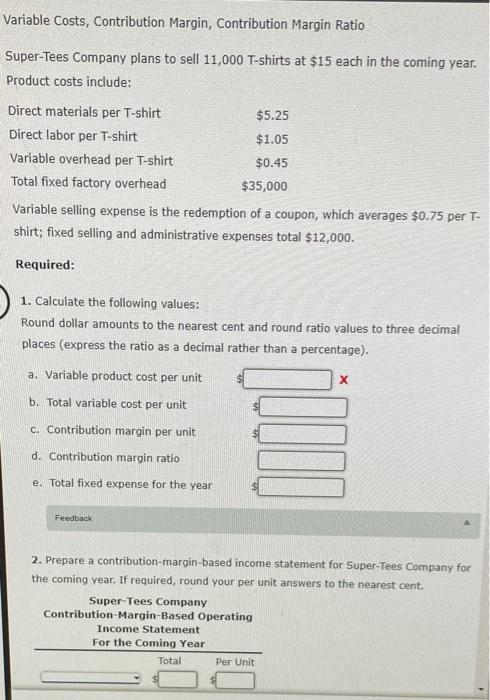

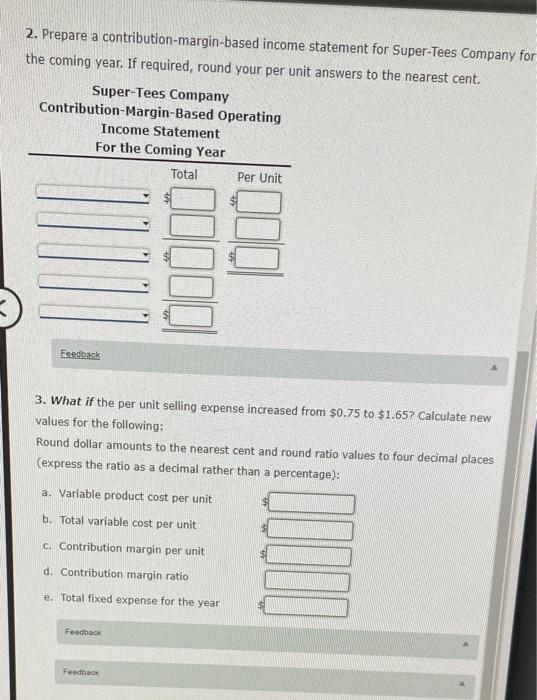

Variable Costs, Contribution Margin, Contribution Margin Ratio Super-Tees Company plans to sell 11,000 T-shirts at $15 each in the coming year. Product costs include: Direct materials per T-shirt $5.25 Direct labor per T-shirt $1.05 Variable overhead per T-shirt $0.45 Total fixed factory overhead $35,000 Variable selling expense is the redemption of a coupon, which averages $0.75 per T- shirt; fixed selling and administrative expenses total $12,000. Required: 1. Calculate the following values: Round dollar amounts to the nearest cent and round ratio values to three decimal places (express the ratio as a decimal rather than a percentage). a. Variable product cost per unit b. Total variable cost per unit c. Contribution margin per unit d. Contribution margin ratio II e. Total fixed expense for the year Feedback 2. Prepare a contribution-margin-based income statement for Super-Tees Company for the coming year. If required, round your per unit answers to the nearest cent. Super Tees Company Contribution-Margin-Based Operating Income Statement For the Coming Year Total Per Unit 2. Prepare a contribution-margin-based income statement for Super-Tees Company for the coming year. If required, round your per unit answers to the nearest cent. Super-Tees Company Contribution-Margin-Based Operating Income Statement For the Coming Year Total Per Unit Feedback 3. What if the per unit selling expense increased from $0.75 to $1.657 Calculate new values for the following: Round dollar amounts to the nearest cent and round ratio values to four decimal places (express the ratio as a decimal rather than a percentage): a. Variable product cost per unit b. Total variable cost per unit C. Contribution margin per unit III d. Contribution margin ratio e. Total fixed expense for the year Feedback Feedback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts