Question: help solve The following table gives data on monthly changes in the spot price and the futures price per lbs for a certain commodity. Spot

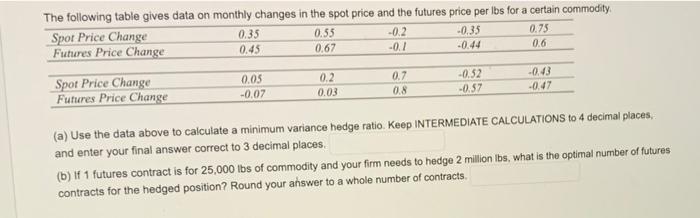

The following table gives data on monthly changes in the spot price and the futures price per lbs for a certain commodity. Spot Price Change 0.35 0.55 -0.2 -0.35 0.75 Futures Price Change 0.45 0.67 -0.1 -0.44 0.6 0.05 0.2 Spot Price Change -0.52 0.7 -0.43 -0.07 Futures Price Change 0.03 0.8 -0.47 -0.57 (a) Use the data above to calculate a minimum variance hedge ratio. Keep INTERMEDIATE CALCULATIONS to 4 decimal places, and enter your final answer correct to 3 decimal places. (b) If 1 futures contract is for 25,000 lbs of commodity and your firm needs to hedge 2 million lbs, what is the optimal number of futures contracts for the hedged position? Round your answer to a whole number of contracts. The following table gives data on monthly changes in the spot price and the futures price per lbs for a certain commodity. Spot Price Change 0.35 0.55 -0.2 -0.35 0.75 Futures Price Change 0.45 0.67 -0.1 -0.44 0.6 0.05 0.2 Spot Price Change -0.52 0.7 -0.43 -0.07 Futures Price Change 0.03 0.8 -0.47 -0.57 (a) Use the data above to calculate a minimum variance hedge ratio. Keep INTERMEDIATE CALCULATIONS to 4 decimal places, and enter your final answer correct to 3 decimal places. (b) If 1 futures contract is for 25,000 lbs of commodity and your firm needs to hedge 2 million lbs, what is the optimal number of futures contracts for the hedged position? Round your answer to a whole number of contracts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts