Question: help soon please process, the CFO has asked you to determine the approcriste weighted average cost of capital ( WACC) to use in the discounted

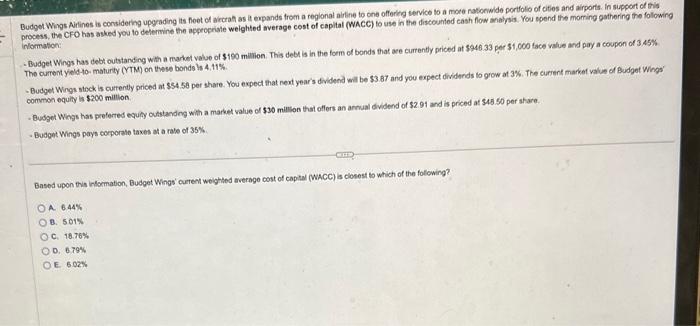

process, the CFO has asked you to determine the approcriste weighted average cost of capital ( WACC) to use in the discounted cash flow analysis. You spend the morring gathering the following inlomaton: - Budget Wings has debt outstanding with a market value of $190 milion. This debl is in the form of bonds that are curtently priced at 5946.33 per $1,000 tace value and pay a coupon of 3.45% The current yieldton maturty (YTM) on these bonds hs 4,11% - Budget Wings atock is curtently priced at $54.58 per share. You expect that next year's dividend will be $3.87 and you expect dividurids io grow at 3%. The current markef value of Budget Wings' common equily is $200 million. - Budget Whgs has preferted equif outslandeg with a market value of $30 milsis that offers an arrual didend of $2.91 and is priced at $45.50 per af are. - Budgent Wings pays corporate taxes at a rale of 35%. Based upon this information, Budget Wing' cureen weighted aversgo cost of captul (WACC) is closest to which of the fotowing? A. 644% B. 501% C. 10.76% D. 679% E. 6.02%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts