Question: Help tackle this. Question 5 Anne & Henry are thinking of buying a retirement cottage in Comwall, and renting it out until they retire. They

Help tackle this.

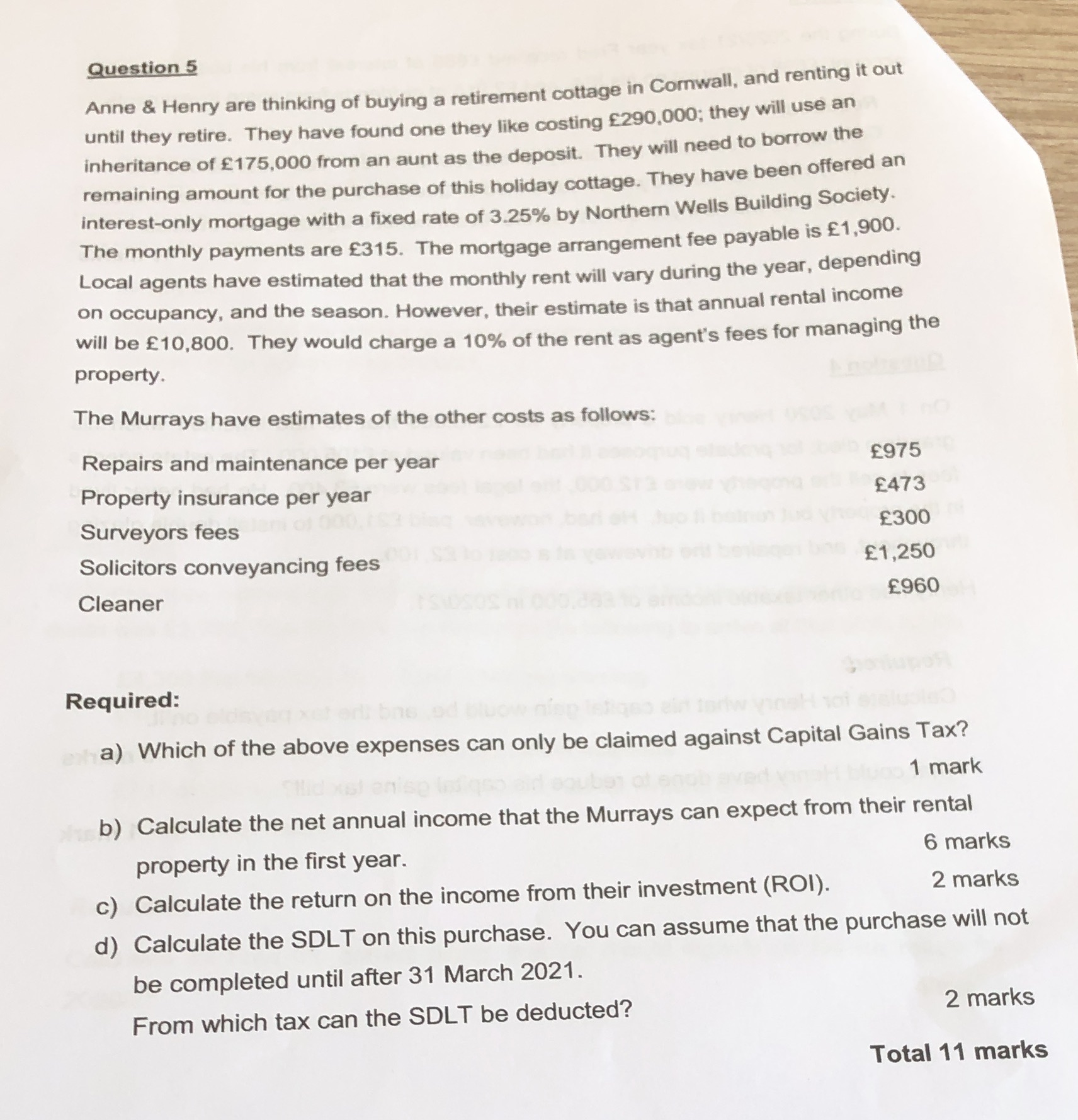

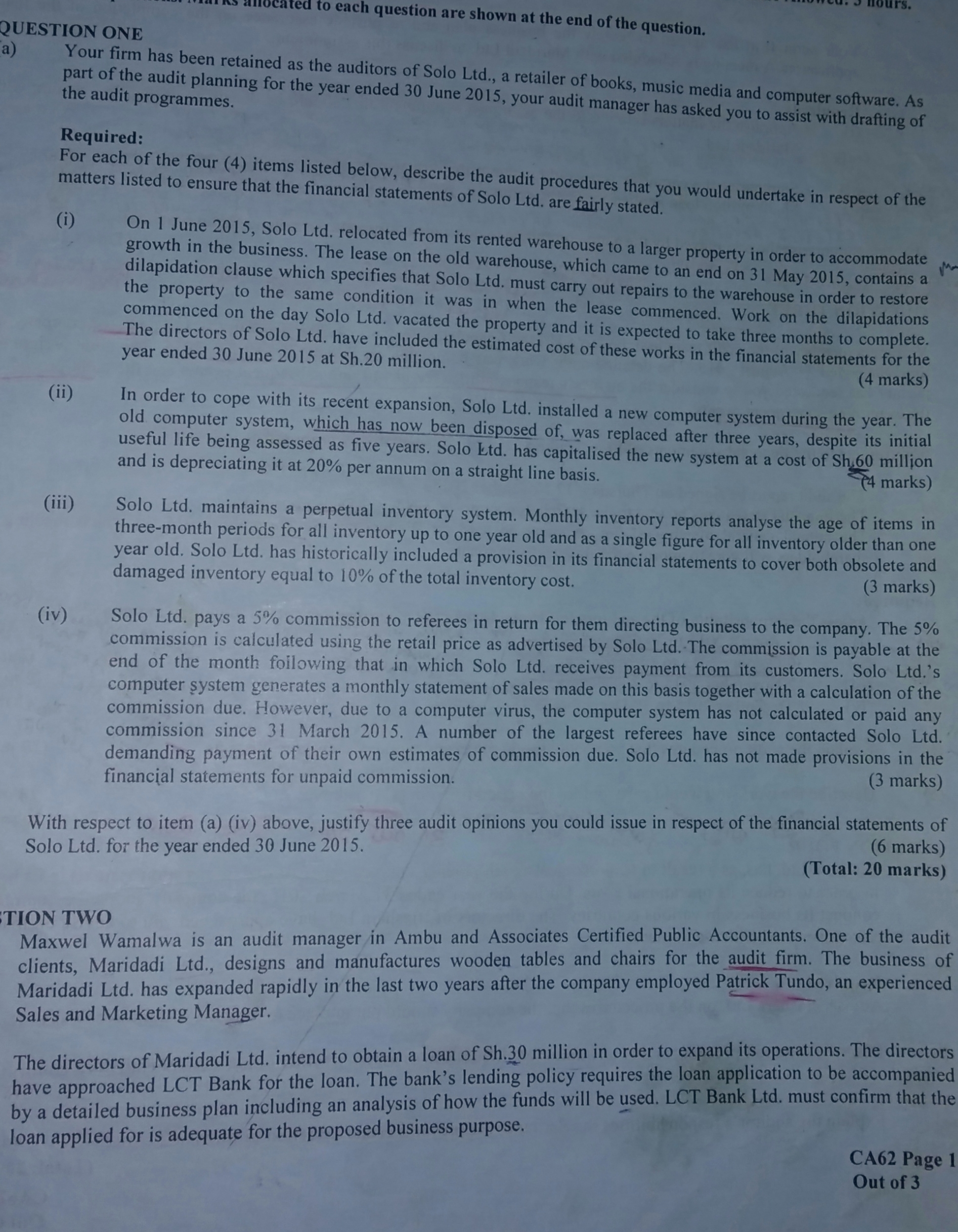

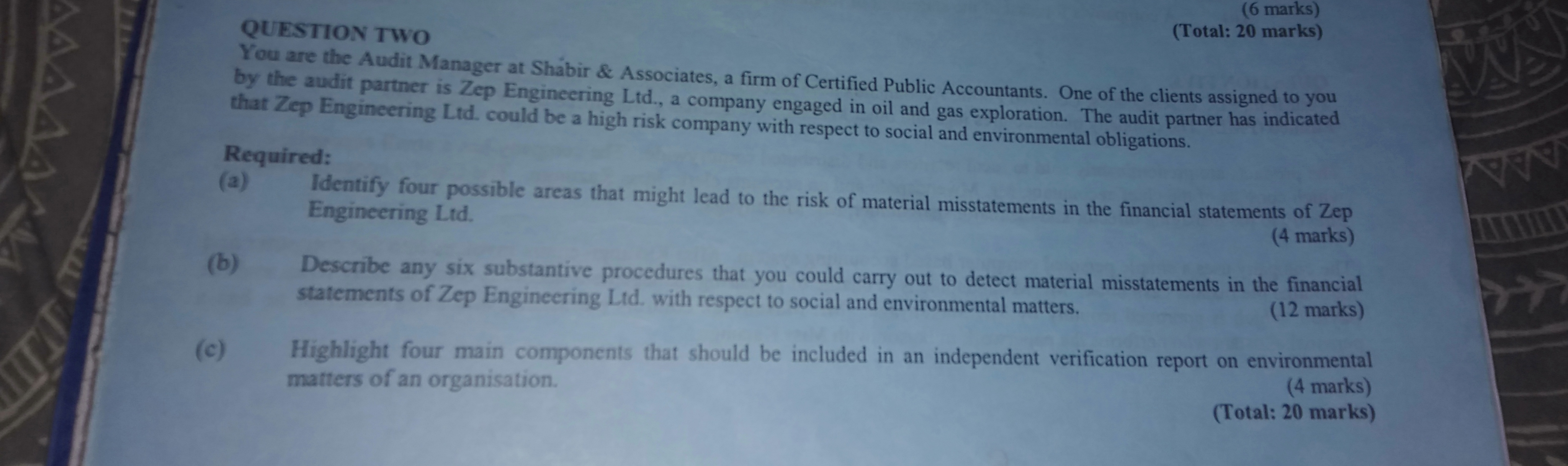

Question 5 Anne & Henry are thinking of buying a retirement cottage in Comwall, and renting it out until they retire. They have found one they like costing $290,000; they will use an inheritance of $175,000 from an aunt as the deposit. They will need to borrow the remaining amount for the purchase of this holiday cottage. They have been offered an interest-only mortgage with a fixed rate of 3.25% by Northern Wells Building Society. The monthly payments are $315. The mortgage arrangement fee payable is $1,900. Local agents have estimated that the monthly rent will vary during the year, depending on occupancy, and the season. However, their estimate is that annual rental income will be $10,800. They would charge a 10% of the rent as agent's fees for managing the property. The Murrays have estimates of the other costs as follows: Repairs and maintenance per year 1975 Property insurance per year E473 Surveyors fees E300 Solicitors conveyancing fees E1,250 Cleaner 1960 Required: a) Which of the above expenses can only be claimed against Capital Gains Tax? 1 mark b) Calculate the net annual income that the Murrays can expect from their rental property in the first year. 6 marks c) Calculate the return on the income from their investment (ROI). 2 marks d) Calculate the SDLT on this purchase. You can assume that the purchase will not be completed until after 31 March 2021. From which tax can the SDLT be deducted? 2 marks Total 11 marksto each question are shown at the end of the question. QUESTION ONE a) Your firm has been retained as the auditors of Solo Lid., a retailer of books, music media and computer software. As part of the audit planning for the year ended 30 June 2015, your audit manager has asked you to assist with drafting of the audit programmes. Required: For each of the four (4) items listed below, describe the audit procedures that you would undertake in respect of the matters listed to ensure that the financial statements of Solo Ltd. are fairly stated. (i) On 1 June 2015, Solo Ltd. relocated from its rented warehouse to a larger property in order to accommodate growth in the business. The lease on the old warehouse, which came to an end on 31 May 2015, contains a dilapidation clause which specifies that Solo Lid. must carry out repairs to the warehouse in order to restore the property to the same condition it was in when the lease commenced. Work on the dilapidations commenced on the day Solo Lid. vacated the property and it is expected to take three months to complete. The directors of Solo Lid. have included the estimated cost of these works in the financial statements for the year ended 30 June 2015 at Sh.20 million. (4 marks) (ii) In order to cope with its recent expansion, Solo Lid. installed a new computer system during the year. The old computer system, which has now been disposed of, was replaced after three years, despite its initial useful life being assessed as five years. Solo Lid. has capitalised the new system at a cost of Sh.60 million and is depreciating it at 20% per annum on a straight line basis. (4 marks) (iii) Solo Ltd. maintains a perpetual inventory system. Monthly inventory reports analyse the age of items in three-month periods for all inventory up to one year old and as a single figure for all inventory older than one year old. Solo Lid. has historically included a provision in its financial statements to cover both obsolete and damaged inventory equal to 10% of the total inventory cost. (3 marks) (iv) Solo Ltd. pays a 5% commission to referees in return for them directing business to the company. The 5% commission is calculated using the retail price as advertised by Solo Lid. The commission is payable at the end of the month following that in which Solo Lid. receives payment from its customers. Solo Ltd.'s computer system generates a monthly statement of sales made on this basis together with a calculation of the commission due. However, due to a computer virus, the computer system has not calculated or paid any commission since 31 March 2015. A number of the largest referees have since contacted Solo Ltd. demanding payment of their own estimates of commission due. Solo Lid. has not made provisions in the financial statements for unpaid commission. (3 marks) With respect to item (a) (iv) above, justify three audit opinions you could issue in respect of the financial statements of Solo Ltd. for the year ended 30 June 2015. (6 marks) (Total: 20 marks) TION TWO Maxwel Wamalwa is an audit manager in Ambu and Associates Certified Public Accountants. One of the audit clients, Maridadi Ltd., designs and manufactures wooden tables and chairs for the audit firm. The business of Maridadi Ltd. has expanded rapidly in the last two years after the company employed Patrick Tundo, an experienced Sales and Marketing Manager. The directors of Maridadi Ltd. intend to obtain a loan of Sh.30 million in order to expand its operations. The directors have approached LCT Bank for the loan. The bank's lending policy requires the loan application to be accompanied by a detailed business plan including an analysis of how the funds will be used. LCT Bank Lid. must confirm that the loan applied for is adequate for the proposed business purpose. CA62 Page 1 Out of 3(6 marks) (Total: 20 marks) QUESTION TWO You are the Audit Manager at Shabir & Associates, a firm of Certified Public Accountants. One of the clients assigned to you by the audit partner is Zep Engineering Lid., a company engaged in oil and gas exploration. The audit partner has indicated that Zep Engineering Ltd. could be a high risk company with respect to social and environmental obligations. Required: AAA V (2) Identify four possible areas that might lead to the risk of material misstatements in the financial statements of Zep Engineering Ltd. (4 marks) (b) Describe any six substantive procedures that you could carry out to detect material misstatements in the financial statements of Zep Engineering Lid. with respect to social and environmental matters. (12 marks) (c) Highlight four main components that should be included in an independent verification report on environmental matters of an organisation. (4 marks) (Total: 20 marks)